Today we’d like to introduce you to Mike Kowis.

Hi Mike, thanks for sharing your story with us. To start, maybe you can tell our readers some of your backstory.

I grew up in Dayton, Texas – a small town not far from the hustle and bustle of Houston. While I loved the quiet rural setting and friendly people of my hometown, I always felt driven to do something more than what Dayton offered. In my senior year of high school, I decided that “something” was to become an attorney. 8 years and 3 college degrees later, I started my dream job in 1996 as a tax attorney in Houston. Just a few years later, I felt another calling to teach college classes. In 2001, I found a part-time gig teaching 3-hour night classes at Lone Star College-Montgomery in The Woodlands and have been enjoying both careers ever since. Not leaving well enough alone, I found a third occupation in 2016 when I wrote and published my first book about college teaching tips. Since then, I’ve written more award-winning nonfiction books on different topics and will soon publish my 6th book. In all of my jobs, I strive to improve myself and do more every day. To the extent that I’ve enjoyed some success, I give credit to two things; the support of a loving family and an unwavering faith in our Heavenly Father above.

We all face challenges, but looking back, would you describe it as a relatively smooth road?

Life has a funny way of making one’s goals more challenging than planned. For example, when I decided to become an attorney, I had neither the money nor the connections to get into a prestigious law school. Only one law school (Thurgood Marshall School of Law in Houston, Texas) accepted my application, and I eventually paid my way with lots of student loans and some financial help from my parents. In the middle of law school, I fell in love with tax law, which meant staying in school an extra year to earn a second law degree. With hard work and a bit of luck, I found my way into the tax law program at Georgetown University Law Center in Washington, DC. The Georgetown law degree opened doors that I never thought possible, and I immediately came back to Houston to start my tax law career. This experience taught me that anything is possible, even if you start life in a small town with modest means and no connections.

Thanks for sharing that. So, maybe next you can tell us a bit more about your work?

My primary job is serving as Senior Tax Counsel for a fortune 500 company. That’s just a fancy way of saying I’m a “tax geek” and work for a large corporation. In fact, I’ve worked in the tax department of Entergy for the last 24 years and counting. Mostly, I spend my days evaluating the income tax treatment of planned transactions and defending the tax treatment upon a later audit by the Internal Revenue Service. As you might imagine, working on complex transactions that sometimes involve hundreds of millions of dollars can be very stressful. But it also means there’s never a dull day. The best part of my day job is working with so many talented, friendly people and also knowing that if I do it correctly, I’ll save money for ratepayers – which includes my neighbors and myself!

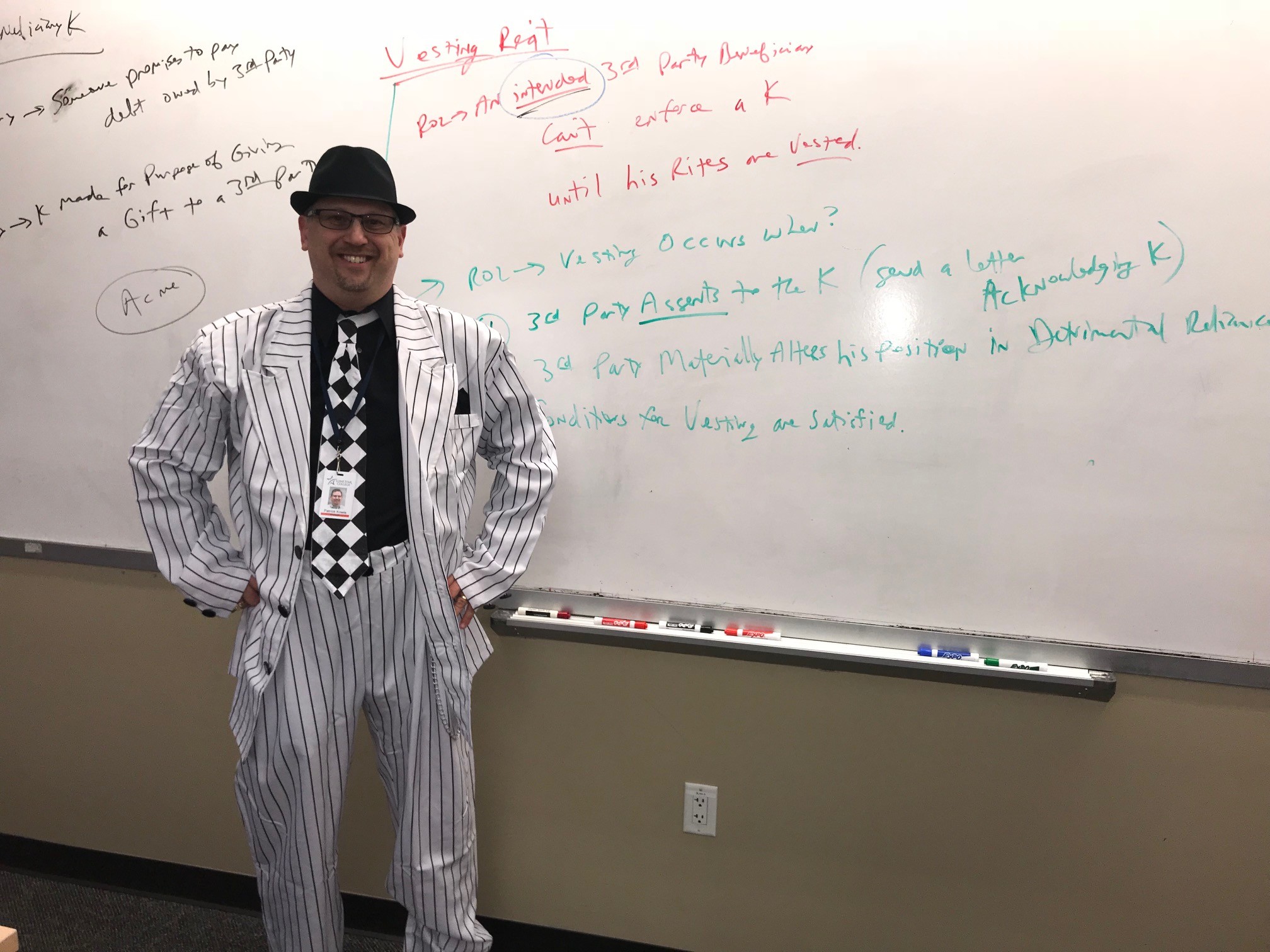

What sets me apart from my colleagues is that I have multiple jobs. In addition to the full-time tax law career, I also enjoy a part-time college instructor gig at Lone Star College-Montgomery. I’ve enjoyed teaching 3-hour business law classes at this community college for 22 years and hope to continue doing so for as long as they’ll let me. Moreover, I began a third career 7 years ago when I wrote and published my first book about college teaching tips. Since then, I’ve written more award-winning nonfiction books about various topics and plan to launch my 6th book soon.

While I wear many hats, the common thread in all of my jobs is that I enjoy helping people.

If you had to, what characteristic of yours would you give the most credit to?

Good communication is the key to my success. Effective communication (which also includes active listening) is critical for a successful career as a tax lawyer, college instructor, and author. When I put on my tax lawyer hat, I’m responsible for writing clear and concise memorandum to explain the income tax treatment and supporting tax guidance for a planned transaction. Similarly, I must be clear and concise when teaching college students and writing nonfiction books. In my opinion, good communication skills are necessary for success in any career.

Contact Info:

- Website: www.mikekowis.com

- Facebook: https://www.facebook.com/mike.kowis.esq

- Linkedin: https://www.linkedin.com/in/mike-kowis-17734535/

- Twitter: @MikeKowis

Image Credits

Yelena Rogers

Mike Kowis