Today we’d like to introduce you to Gunveen Bachher.

Today we’d like to introduce you to Gunveen Bachher.

Hi Gunveen, we’d love for you to start by introducing yourself.

In late 2019, I obtained my professional license, a milestone that initially held great promise. However, as time passed, I found myself increasingly dissatisfied with my job. The sense of stagnation was palpable; I yearned for growth and the chance to catch the elusive break I so desperately craved. Then, as fate would have it, a pivotal decision awaited me just before the onset of the global pandemic.

Stepping away from my job seemed like a bold move, but I believed it was the right one. And looking back now, I can confidently say that it was the best decision of my life. As the world grappled with the challenges posed by COVID-19, I embarked on a new chapter, one that had been years in the making. In January 2020, I took the plunge and launched my own business. Notably, I designed it to operate entirely online, affording me the freedom to work from any corner of the country.

My journey into entrepreneurship had been in the making for a decade, a dream nurtured but never fully realized until that moment. The pivotal turning point arrived in 2019 when I found myself weary of the status quo, prompting me to transition full-time into my business venture. Looking back, this transition marked a turning point that has shaped the trajectory of my professional life.

Fast forward to the present, and I find myself in the midst of my fourth year of business operations. What began as a leap of faith has blossomed into a thriving CPA practice deeply rooted in Houston. Specializing exclusively in real estate taxes and accounting, our practice has gained significant traction. A testament to our success is the fact that every single one of our clients is deeply connected to the realm of real estate. Whether they are full-time investors, syndicators, wholesalers, property flippers, or private landlords, our client base reflects the breadth and diversity of the real estate landscape.

This journey has been one defined by risk, determination, and the unwavering pursuit of a vision. From the inception of my business to its current state, the challenges have been manifold, but so too have the rewards. As I reflect on this path I’ve chosen, I am both proud of how far I’ve come and excited for the possibilities that lie ahead. The decision to embrace entrepreneurship has transformed my life, reshaping my career and allowing me to carve out a niche in the dynamic world of real estate taxes and accounting.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way? Looking back, would you say it’s been easy or smooth in retrospect?

Absolutely, my journey has been a tapestry woven with struggles and challenges, each thread contributing to the intricate fabric of my path. The odyssey began in January 2020, a pivotal year marked by the inception of my business, coinciding rather inauspiciously with the emergence of the COVID-19 pandemic. This convergence of events presented a formidable trial right at the dawn of my entrepreneurial venture.

Navigating through the uncharted waters of entrepreneurship, I was tasked not only with cultivating the spirit of a business owner but also with the daunting process of establishing frameworks and protocols. The learning curve was nothing short of precipitous, for I was not merely acquainting myself with the fundamentals of business operation; I was sculpting a digital presence from the very outset. This instinctive foresight led me to shape my business in the virtual realm, a decision I believed would position me optimally for the evolving landscape.

The initial challenges were a triad: sculpting a business identity, fashioning an online infrastructure, and mastering my newfound niche—real estate taxes. Having spent over two decades in the accounting realm, the intricacies of real estate specialization presented an invigorating yet formidable undertaking.

The dawn of the subsequent year ushered in fresh trials but of a different nature. With the foundation relatively solidified, the focus shifted to the art of scaling. The inaugural year, against all odds, yielded promising results, with a customer base established and financial stability achieved.

But the sequel would not be complete without the pursuit of growth. Scaling brought with it an entirely new set of challenges, ranging from attracting larger and more discerning clients to grappling with the intricacies of hiring and assembling a competent team. The choice between contractors and W2 employees, the endeavor of identifying the right talents, and the orchestration of a marketing budget formed the crux of this stage.

As you know, we’re big fans of GavTax Advisory Services. For our readers who might not be as familiar, what can you tell them about the brand?

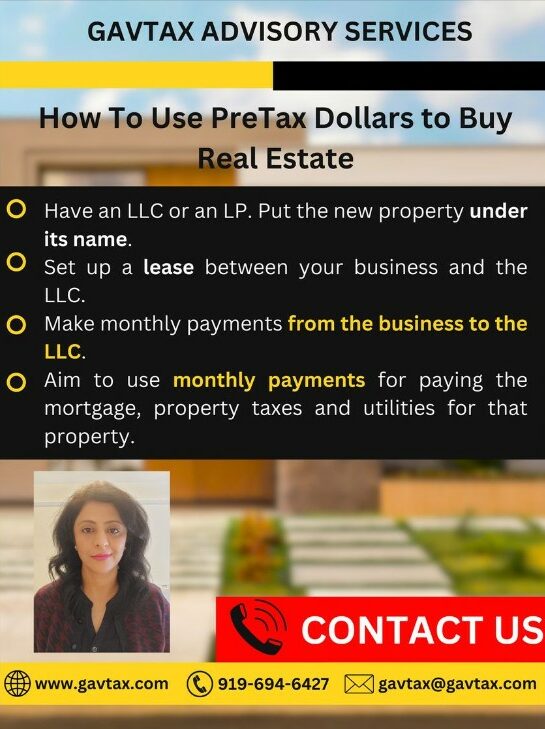

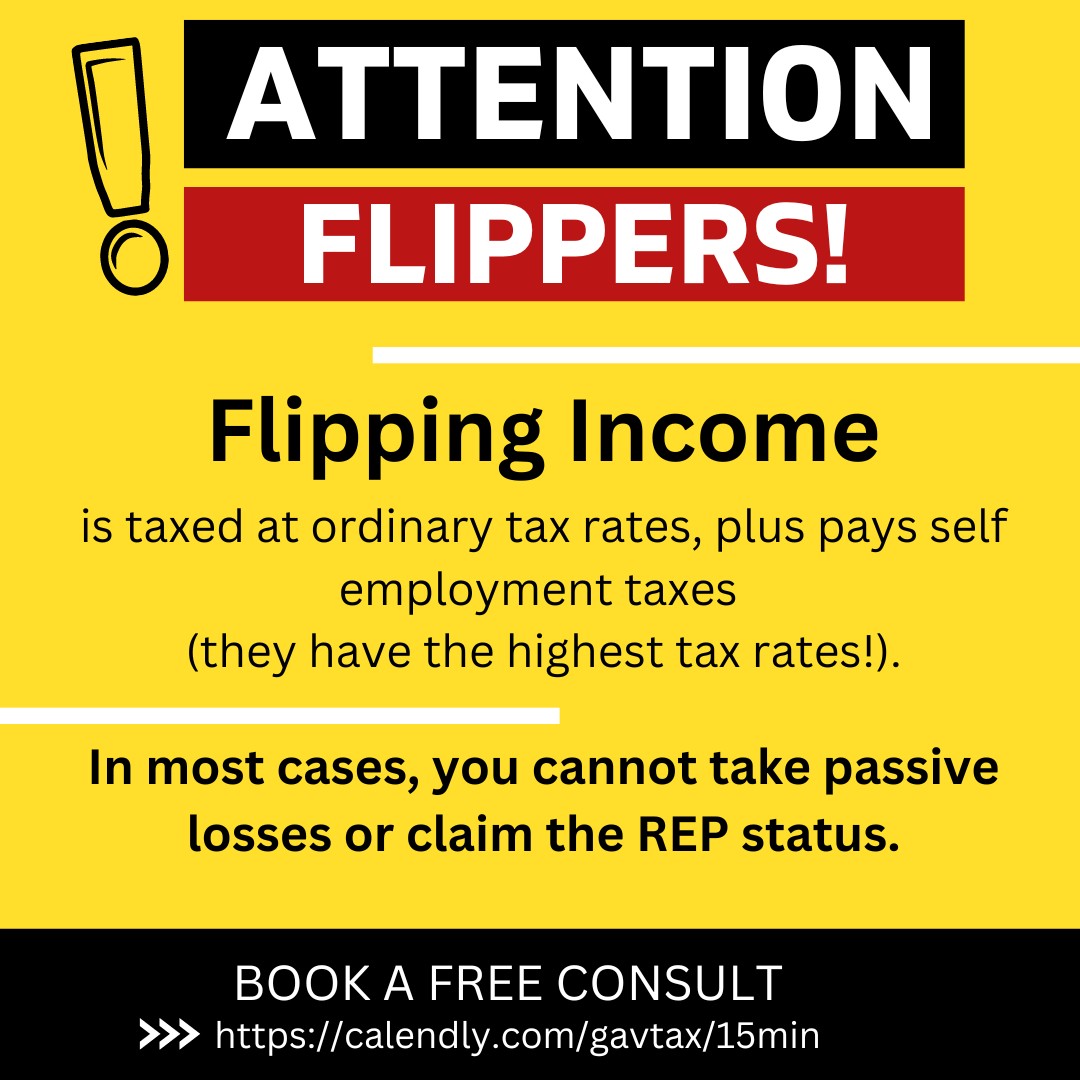

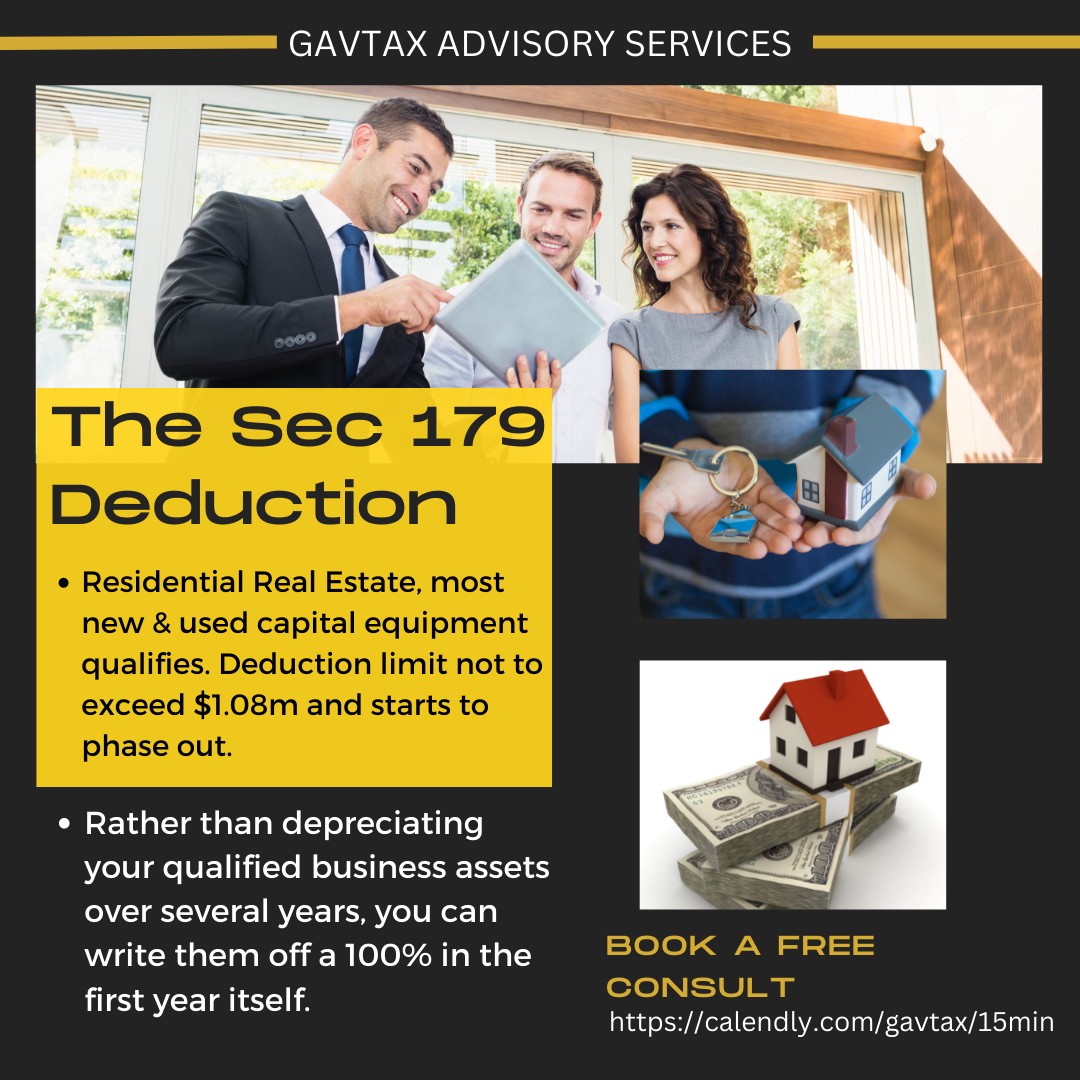

We help Real Estate Investors scale their portfolio while minimizing their tax burden. Even experienced investors end up saving tens of thousands on their taxes with our strategic recommendations. As a real estate strategist and not someone who just plugs in numbers, we’ll sit down together at least quarterly to proactive plan on how to maximize your investment returns. We use Tax Planning and Advanced Accounting Methods to help maximize your real estate investment gains.

We specialize in real estate taxes and accounting, and therefore, the services we offer encompass tax planning and tax savings for Real Estate Investors, as well as entity structure selection information. Additionally, we provide regular tax services such as tax preparation, amendment of tax returns, and accounting work involving bookkeeping. These constitute the four main comprehensive services that we offer.

What sets our brand apart is the fact that only a few CPA firms and accounting firms actually specialize in real estate taxes. Given the inherent complexity of real estate taxes and accounting, there are very few accounting firms or CPAs that specialize in areas such as tax savings, tax reduction, proper entity structuring, meticulous bookkeeping practices, and the correct setup of chart of accounts. Furthermore, understanding the accounting implications on the tax preparation process is an intricate matter, and not many accountants possess this comprehension. This distinguishing factor is what truly sets us apart from the rest.

Our initial consultation is offered at no charge. We are also one of the few Real Estate CPA firms that have a massive social media presence where we regularly post free content for our subscribers.

Where we are in life is often partly because of others. Who/what else deserves credit for how your story turned out?

Honestly, no mentors. Just me, myself, and Irene all along.

Pricing:

- $295 For a 45 min Tax Consultation

- $1,000 upwards for Individual Tax Preparation

- $1,400 upwards for Business Tax Preparation

- $550 and upwards for monthly bookkeeping

- $750 For Entities

Contact Info:

- Website: https://gavtax.com/

- Instagram: https://www.instagram.com/gavtaxplanning/

- Facebook: https://www.facebook.com/gavtax2021

- Twitter: https://twitter.com/gav_tax

- Yelp: https://www.yelp.com/biz/gavtax-advisory-services-houston-2

- Other: https://calendly.com/gavtax/15min

Image Credits

GavTax Advisory Services LLC