Today we’d like to introduce you to Amol Desai.

Hi Amol, thanks for sharing your story with us. To start, maybe you can tell our readers some of your backstory.

I grew up in India in the nineties in a typical middle-class family focused on good quality education. While I was earning my bachelor’s degree in production engineering (know as Industrial Engineering in the US) from University of Mumbai, I was also witnessing the beginnings of a strong economic growth the country was embarking upon as a result of opening up of India’s markets to the world. The seeds of my curiosity about finance and economics were sowed then, but were dormant for many years.

I moved to the US in 2003 to pursue my Master of Science in Mechanical Engineering and worked in diverse engineering industries after graduation. As the world was experiencing the Great Recession of 2008-2009, those events again stirred my interest in learning deeply about finance and I decided to get my MBA with finance concentration from Rice University here in Houston.

After my MBA, I worked as a Decision Analysis Consultant to clients primarily in the Oil and Gas industry helping them think strategically about their capital investments and building financial models to optimize the business decisions they faced in uncertain environment.

While I was enjoying my career growth during these years, with growing level of my income and assets, it occurred to me that the opportunities around personal finance and investing landscape here in the US is filled with nuances that are different in many ways to the system I was used to back in India. Even though I was academically trained in finance by now, I realized that thinking about and planning personal finances when you still have roots and hold assets in your home country, adds an extra layer of complexity and requires the relevant know-how. I was observing that the challenge was not unique to me but very common to many first-generation Americans who migrated here for graduate studies years ago and now depend on friends and social media for any information that may help them plan and manage their wealth. Few always looked for local financial advisors to guide them professionally. However, the financial advisors who may have the relevant expertise around cross-border financial planning issues and who can understand and culturally relate to potential first-generation American clients were very rare to come by and they still are.

To enhance my knowledge and skillset I further undertook a rigorous curriculum of the CFA program requiring years of studying, passing three levels of exams with increasing difficulty level and relevant experience. I am now a CFA® charterholder since 2017. I have also acquired my CFP designation in 2022 and Global Financial Planner designation (GFP Fellow) in 2023.

Having acquired the right credentials, experience and the understanding of nuanced needs of any first-generation American (especially who came here from India), back in 2020, I decided to transition from my management consulting role in the corporate to launching my own Financial Planning and Investment Management firm serving a particular niche of First-Generation Americans and Mid-career Professional.

When not working, I enjoy traveling to national parks, camping and hiking. I also enjoy exploring different foods and trying out new restaurants with family and friends. Indian classical music is something I feel very relaxing and you will find me with my headphones when I am working out or on a beautiful hike.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

It was definitely not a smooth road. It took a lot of time, efforts and patience to identify and understand the needs of people with similar background as mine. First challenge I had to go through was career transition without clearly knowing where I was heading. When I first started my MBA in finance, I only know that I am interested in learning deeply about economics and finance, but the idea of launching my own advisory firm never occurred to me at that time and it was a slow evolution of thoughts. As I was gaining more and more clarity around what I wanted to do, it was clear that I needed to get even more education via the CFA and CFP certifications. To self motivate to complete these certifications and keep persevering for years was a tough task.

Even after having these credentials and a few years of corporate experience, it felt very risky to transition completely towards launching & running a business in personal finance – especially when I had no prior experience of that. Deciding to quit a well paying consulting job and opting for a few years of financial difficulty in the start was daunting.

Also when you start something very new, there are always self-doubts and imposter syndrome that you face and have to overcome by focusing on your work. As I got to work more and more on different client scenarios, it gave me a lot of confidence.

Another challenge was there were not many advisors at that time who were experienced cross-border financial planners. It made it very difficult for me to find some mentor-like professional with whom I can brainstorm my challenges and potentially learn from his/her experience.

Having said that, being associated with a few professional industry organizations definitely helped me a lot to navigate my initial years in this industry.

Thanks for sharing that. So, maybe next you can tell us a bit more about your business?

Perceptive Wealth Advisors is a Fee-Only, Independent and Fiduciary firm serving First-Generation Americans and Mid-career Professionals. We hold the following values at our core:

✔️ Service: Be helpful and always look to provide value through our work

✔️ Diligence: Approach work with focus and attention to detail

✔️ Humility: Always be humble in every client relationship and be open to feedback

✔️ Continuous Learning: Commit to staying up to day with knowledge and skills

✔️ Live With Purpose: Strive for intent & balance in life instead of just pursuing materialistic goals without knowing why

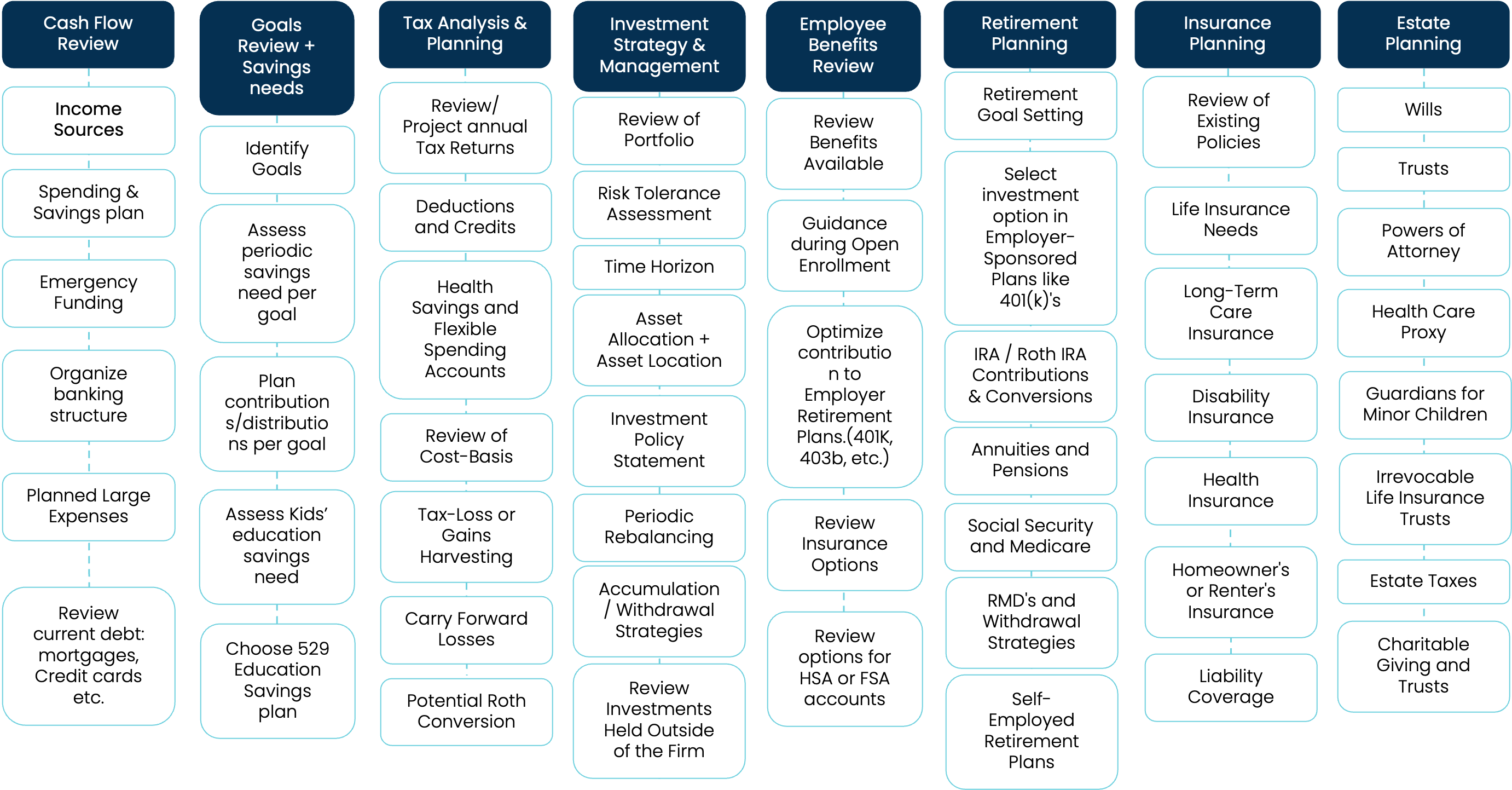

Our service is Comprehensive Financial Planning which includes Investment Management, but goes much beyond that. Several personal finance issues that are addressed are: Cash-flow Planning; Goals Setting & Savings Needs Assessment; Tax Planning; Employee Benefits Review; Investments Planning & Management; Retirement Planning; Insurance Planning and Estate Planning. The attached graphic shows potential tasks/subtopics under each of the these broader areas of personal finance, that we tackle.

In addition, for my specific niche of First-Generation Americans, there are often some key questions that need careful planning and attention. e.g.:

– What are the tax implications of holding assets in 2 countries?

– Should I report my assets in India to the IRS? If yes, when and how should I report it?

– Will there be any tax liability?

– What are the penalties for non-compliance?

– Should I keep investing in India? Or Should I liquidate and bring everything to the US?

– How does the foreign exchange risk play out and how to manage it?

Being a first-generation Indian immigrant myself, I have experienced firsthand what it takes to come to a new country for education, go through an exhaustingly long process of immigration while building a career, slowly familiarizing yourself to a foreign financial system and trying to research, understand and navigate the issues involved when maintaining assets in India in addition to the US. Optimizing your financial life here in the US while still having roots back home (I still have my parents and sister in India) requires understanding of an extra layer of complexity than any other regular advisory firm. My clients depend on such understanding and often rely on the fact that I come from a similar background and incorporate my own experiences in the planning and investment management that I do for them. My ability to ask the right questions around my clients’ cross-border planning issues when I first start working with them often distinguishes me from the other advisory firms.

What do you like best about our city? What do you like least?

Houston metro area has a lot of diversity. I enjoy the food options to explore from all over the world. Despite being one of the biggest cities in the country it has a very reasonable cost of living.

Dislikes: The summer heat and high levels of traffic on roads.

Pricing:

- One-time upfront fee ranging from $1500 to $4000 depending on the complexity of needs

- Ongoing fees are % of Assets Under Management subject to an annual minimum of ~ $4000-$5000

- Upto $1MM assets under management – 1%

- $1-3MM = 0.75% fee

- Assets over $3MM = 0.5% fee

Contact Info:

- Website: https://perceptivewealth.com/

- Facebook: https://www.facebook.com/PerceptiveWealth/

- Linkedin: https://www.linkedin.com/in/amol-desai/