Today we’d like to introduce you to Jareema.

Hi Jareema, so excited to have you on the platform. So before we get into questions about your work-life, maybe you can bring our readers up to speed on your story and how you got to where you are today?

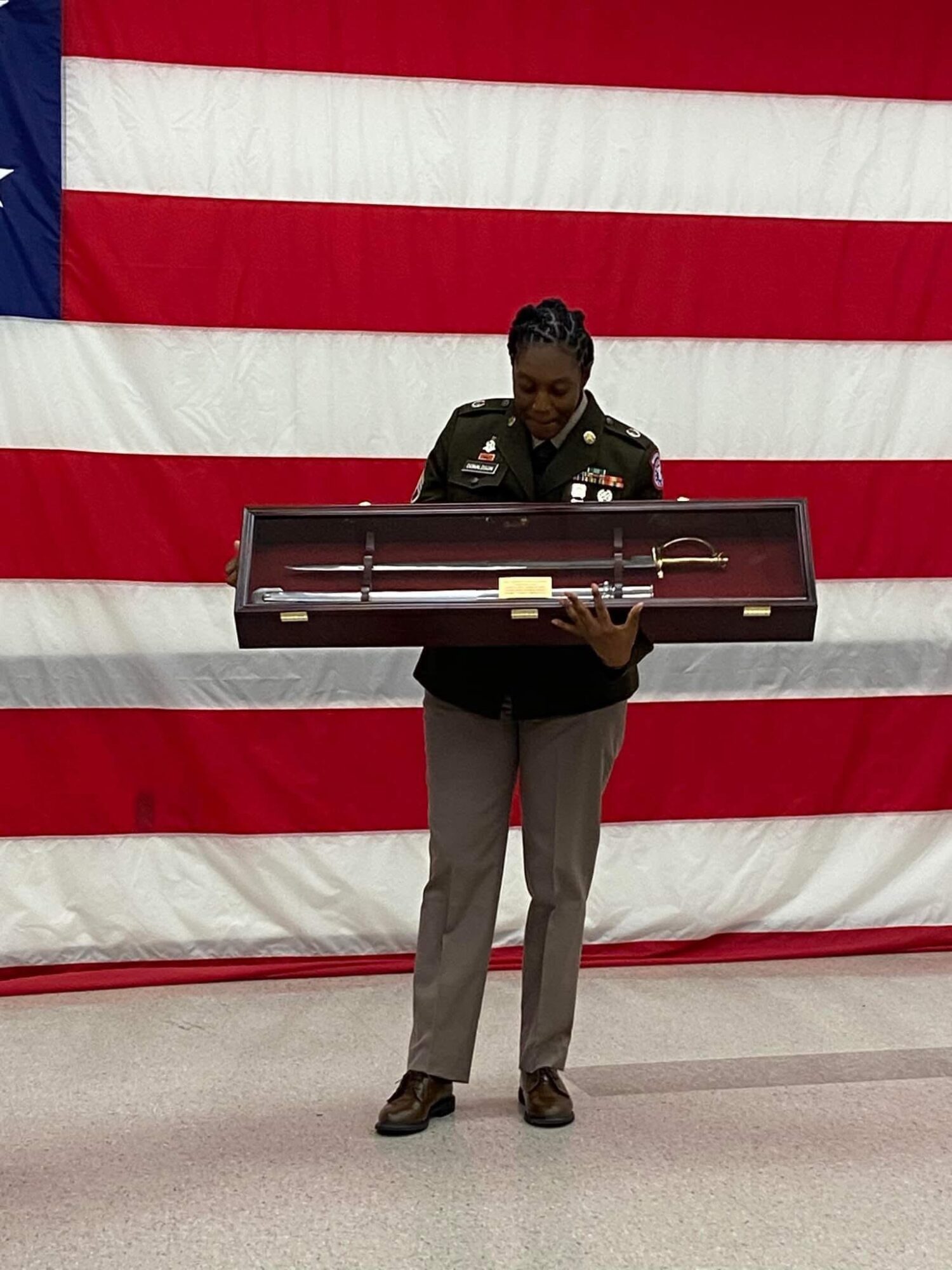

After serving in the military, I discovered my next calling wasn’t just about discipline and leadership — it was about helping people make sense of their money. I’ve always had a strong interest in numbers and how financial systems work, which led me to pursue a degree in Finance at Prairie View A&M University, with a minor in Accounting and Personal Financial Planning.

Early in my studies, I realized I didn’t just want to work with numbers — I wanted to help others understand them. That realization became the spark behind my venture, Diamond Trust Financial Services, a company I built from the ground up to focus on financial literacy, bookkeeping, tax preparation, life insurance, and financial goal setting.

Starting a business while pursuing my degree was challenging, but also deeply rewarding. It taught me about the realities of entrepreneurship — from compliance and client relations to marketing and digital strategy — but more importantly, it showed me the real-world impact of financial education. I’ve seen firsthand how a better understanding of budgeting, credit, and investments can transform someone’s confidence and future.

Alongside my business, I’ve also stayed deeply involved on campus. Serving as President of the Student Veterans Association and Treasurer for the National Society of Leadership and Success (NSLS) allowed me to bridge worlds — connecting veteran students with traditional college students while developing skills in teamwork, leadership, and advocacy.

Today, I’m continuing to expand my expertise by preparing for the Securities Industry Essentials (SIE) exam, with plans to move into financial advising and wealth management. Every step of my journey — from military service to entrepreneurship — has been about growth, empowerment, and purpose.

Ultimately, my story isn’t just about building a business; it’s about building trust, financial freedom, and a legacy that helps others do the same.

“My mission is to empower individuals and families to take control of their finances through education, discipline, and trust — building the foundation for lasting generational wealth.”

Alright, so let’s dig a little deeper into the story – has it been an easy path overall and if not, what were the challenges you’ve had to overcome?

No, it definitely hasn’t been a smooth road — but every challenge has shaped who I am today.

Coming from the military, I was used to a structured environment where everyone shared a mission-first mindset. Transitioning into civilian life and the business world showed me that not everyone operates with that same level of focus or discipline. It took time to adjust my expectations, communicate differently, and learn how to motivate people in new ways.

Being a nontraditional student added another layer of challenge. Returning to school after years of real-world experience meant learning alongside peers who were still figuring out adulthood. That inspired me to become an advocate — not only for myself but also for students who may not yet have the confidence or life perspective to speak up for themselves.

Entrepreneurship has been its own battlefield. Building Diamond Trust Financial Services from scratch requires consistency, patience, and a lot of faith. I wear many hats — from administrator and marketer to bookkeeper and advisor — and I’ve had to learn how to prioritize, delegate, and simplify wherever possible.

But the hardest part isn’t the workload; it’s helping people face what they often fear most — their finances and the habits behind them. Many people would rather avoid the topic altogether. My mission is to change that narrative, one conversation at a time, by showing that financial growth starts with honesty, education, and small, consistent steps.

Appreciate you sharing that. What should we know about Diamond Trust Financial Services?

Diamond Trust Financial Services was built on one core belief — that financial literacy is the foundation of freedom. I started the business to bridge the gap between financial confusion and financial confidence for individuals, families, and small business owners who want to take control of their money but don’t know where to start.

At Diamond Trust, we specialize in bookkeeping, tax preparation, life insurance, debt management, budgeting, and personalized financial goal-setting. But beyond the services, what truly sets us apart is our approach — we educate first. My goal is not just to manage the numbers for clients but to help them understand them. I believe that when people understand how money works, they make better decisions that lead to long-term stability and generational wealth.

What makes Diamond Trust unique is our personalized touch and community-driven focus. I work one-on-one with clients, tailoring solutions to fit their financial goals, lifestyle, and stage of life — whether that means cleaning up debt, building a budget, or preparing for business growth. Every client relationship is built on transparency, accountability, and trust.

Brand-wise, I’m most proud of how far we’ve come in such a short time. What started as an idea has grown into a trusted resource for financial empowerment. Seeing clients transform their financial habits and gain confidence in their futures is the most rewarding part of what I do.

For readers, I want you to know that Diamond Trust Financial Services isn’t just about taxes and numbers — it’s about transformation. Whether you’re trying to rebuild, start fresh, or plan for the future, we meet you where you are and help you get where you want to be — one step, one goal, one plan at a time.

Is there something surprising that you feel even people who know you might not know about?

Most people are surprised to learn that, outside of finance, I have a deep fascination with the human body and holistic wellness — how it works, how it heals, and how our habits and mindset influence overall health. I truly believe that financial wellness and physical wellness go hand in hand; both require awareness, discipline, and consistency. Just like the body, our finances thrive when we give them care and attention.

Another thing people might not expect is that I love riding my motorcycle. It’s my way to clear my mind, feel free, and reset after long workdays. There’s something peaceful about being on the open road — it reminds me to enjoy the journey, not just the destination.

Those two passions — wellness and riding — both reflect who I am at the core: someone who values balance, growth, and freedom in every area of life.

Contact Info:

- Website: https://www.diamondtrustfs.com

- Instagram: diamondtrustfs

- Facebook: Diamond Trust Financial Services

- LinkedIn: https://www.linkedin.com/in/jareema-donaldson/