Laura Sanders MBA shared their story and experiences with us recently and you can find our conversation below.

Laura, a huge thanks to you for investing the time to share your wisdom with those who are seeking it. We think it’s so important for us to share stories with our neighbors, friends and community because knowledge multiples when we share with each other. Let’s jump in: Have any recent moments made you laugh or feel proud?

Last year, I began financial coaching a client who was living paycheck to paycheck, had a negative net worth, and struggled with a scarcity mindset. Because of past experiences from their childhood, they substantially overspent on food due to experiences with food insecurity, in addition to other things. We started out spending a lot of time working on their money mindset to address their childhood trauma when it came to money. We’ve continued to coach financially, and after the first quarter of this year, they had a positive net worth. We were both ecstatic over their progress. However, at the end of the last quarter, when we conducted their quarterly review, not only did they have a positive net worth, but it was a five-figure net worth.

This was a client who, only a year ago, didn’t know what to expect from financial coaching, but knew they didn’t want to stay where they were financially. During that call, my client cried with sheer joy and overwhelm at how far they had come. They reflected on their childhood and how they once thought they could never achieve what they now have. This moment made me immensely proud. I’m proud of the dedication and work my client and I have both put in. It’s moments like this that make me the most proud of what I do.

Can you briefly introduce yourself and share what makes you or your brand unique?

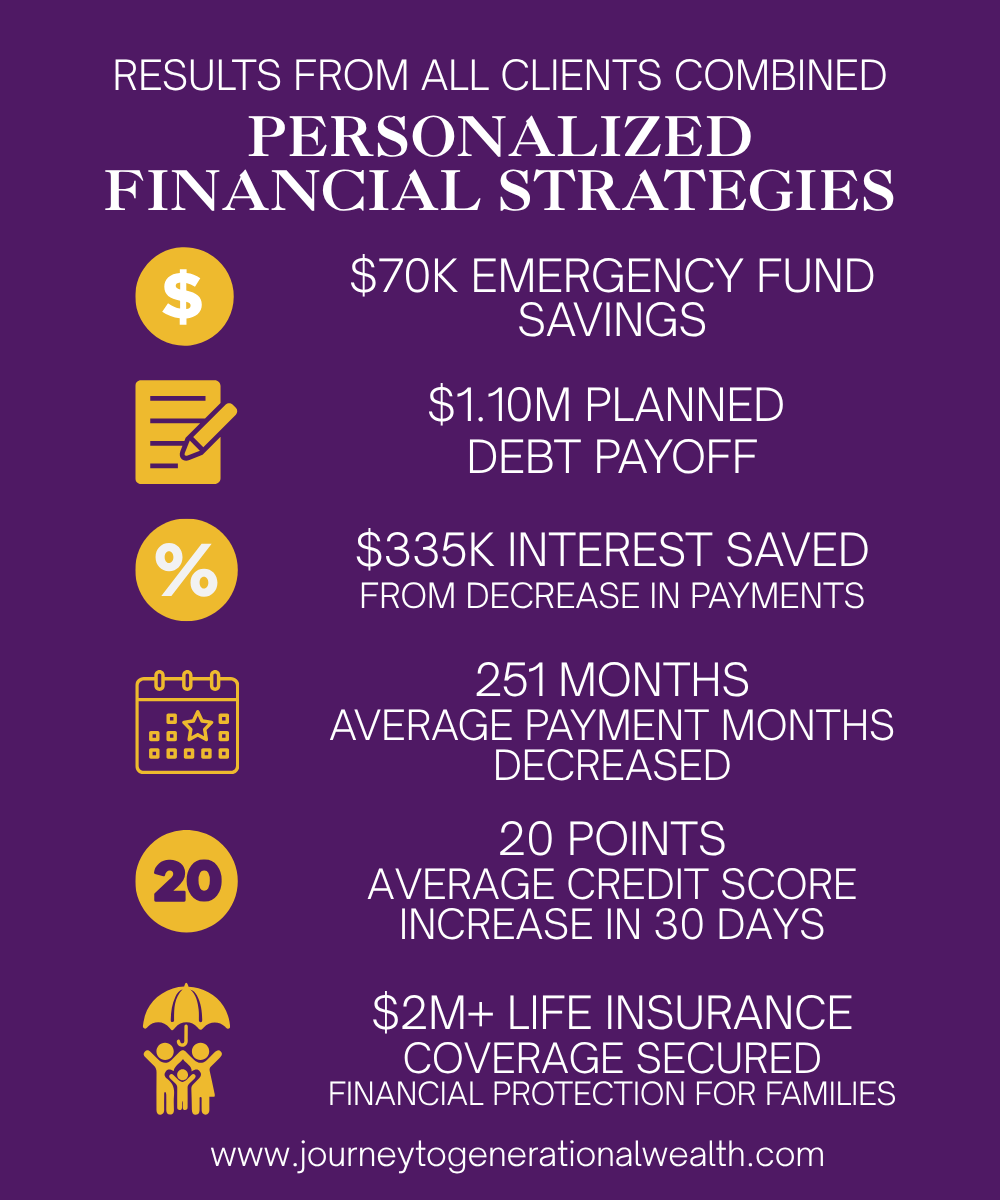

My name is Laura Sanders, MBA, and I’m the Founder of Journey To Generational Wealth®, where I empower professional women of color to break financial barriers, eliminate debt, build savings, and create lasting legacies. I focus on women because I believe that when women gain financial clarity and confidence, they naturally extend that knowledge and security to their families, and that ripple effect strengthens our entire community.

What makes my brand unique is that it blends my expertise as a financial coach, legacy and estate planning strategist, author, and speaker with my passion for making financial literacy accessible and relatable. I don’t just discuss numbers, I help women shift their money mindset, create actionable plans, and protect what they’re building for the next generation.

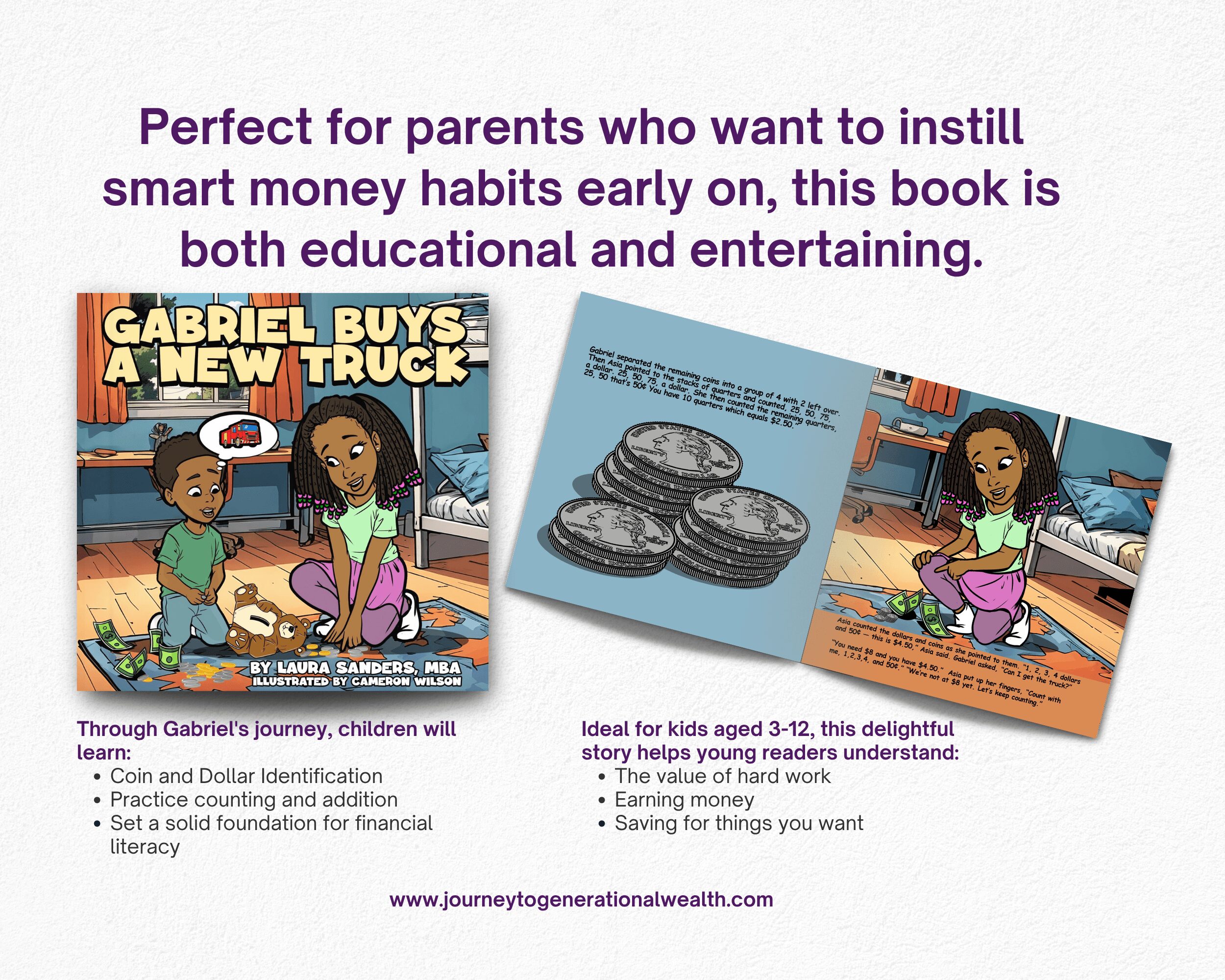

Through coaching programs, eBooks, toolkits, children’s financial literacy classes, and even apparel that sparks conversations about wealth, my mission is to normalize financial stability and legacy planning within families so that wealth can be preserved and multiplied across generations. This work also extends through the nonprofit I founded, The Crayons & Coins Financial Literacy Foundation, which equips underserved youth with the financial skills they need to succeed as they transition into adulthood.

Currently, I’m expanding both my coaching and publishing arms with new resources, including toolkits, courses, and children’s books, all designed to help families build and protect their generational wealth. At the core, my story is about transformation, turning knowledge into empowerment and helping others do the same so that wealth becomes the norm, not the exception, in our communities.

Thanks for sharing that. Would love to go back in time and hear about how your past might have impacted who you are today. Who were you before the world told you who you had to be?

Before the world told me who I had to be, I was a little girl with a big imagination; a natural teacher, a leader, and a dreamer who believed anything was possible. Creativity, curiosity, and compassion guided everything I did. That part of me has never left; it’s what empowers me today to help women, families, and communities reclaim their power and write their own legacy.

When did you stop hiding your pain and start using it as power?

For a long time, I carried the weight of financial mistakes in silence. In my early twenties, while married, I thought I was doing all the ‘right things’: paying off debt, buying cars, and purchasing a home. But when my marriage ended, I came face-to-face with how unprepared I really was. I lost assets, took on debt that wasn’t entirely mine, and was forced to rebuild from a financial deficit.

In the years that followed, I fell into what I call ‘financial foolery.’ These were choices that felt right in the moment but set me back. For years, I hid those missteps out of shame, believing they disqualified me from ever being financially wise.

I stopped hiding when I realized my story wasn’t a source of shame but a source of strength. My experiences became the very lessons that allow me to teach others. Today, I use my pain as a source of power by showing women, families, and communities that no matter where you start or what you have lost, you can rebuild, reclaim your financial power, and create a lasting legacy.

Alright, so if you are open to it, let’s explore some philosophical questions that touch on your values and worldview. Where are smart people getting it totally wrong today?

Many smart, accomplished women of color are often taught to chase higher income, yet true wealth comes from managing and protecting what you already have with clarity and intention. We climb the ladder, secure the degrees, get the promotions, and believe the paycheck alone will guarantee stability. But wealth isn’t built on income alone. It’s built on clarity, intentional planning, and protection.

Too often, I see brilliant, capable women pouring themselves into their careers while putting off conversations about debt elimination, saving strategically, life insurance, estate planning, or even investing. The mistake isn’t in their ability; it’s in the assumption that time is on their side or that these things can wait until later.

What I teach my clients is this: you don’t have to wait until you’re making six figures or feel ‘fully ready’ to build generational wealth. The smartest move you can make is to start now, with what you have, and protect both your present and your future. Success without strategy can crumble, but strategy, even in small steps, will always create legacy.

Okay, we’ve made it essentially to the end. One last question before you go. What is the story you hope people tell about you when you’re gone?

When God calls me home, I hope people say that I lived a life of purpose, faith, and impact. I used my gifts to empower women, families, and communities to believe in themselves, take control of their finances, and protect what they’ve built for future generations. I want to be remembered as someone who broke barriers, created opportunities, and made financial literacy accessible and relatable.

More than the books I wrote, the businesses I built, or the resources I created, I hope my story is that I helped people see their worth, build their confidence, and leave legacies that outlived them. If generations are stronger, freer, and more secure because of something I taught, shared, or inspired, then my life will have been well spent.

Contact Info:

- Website: https://www.journeytogenerationalwealth.com

- Instagram: https://www.instagram.com/journey2generationwealth/

- Linkedin: https://www.linkedin.com/company/journeytogenerationalwealth

- Facebook: https://www.facebook.com/journey2generationwealth/

- Youtube: https://www.youtube.com/@JourneyToGenerationalWealth

- Other: https://www.tiktok.com/@journey2generationwealth; www.crayonsandcoins.org