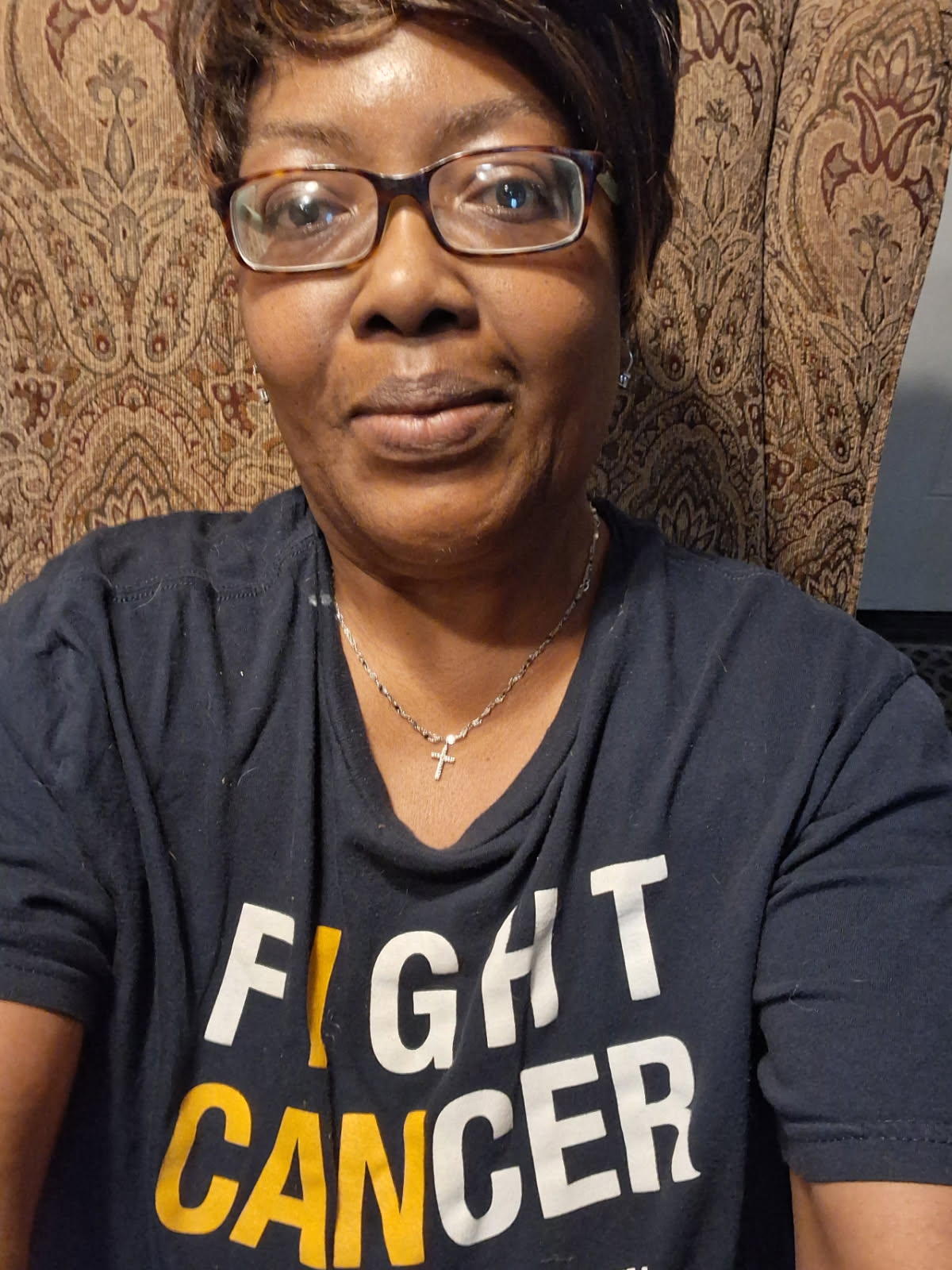

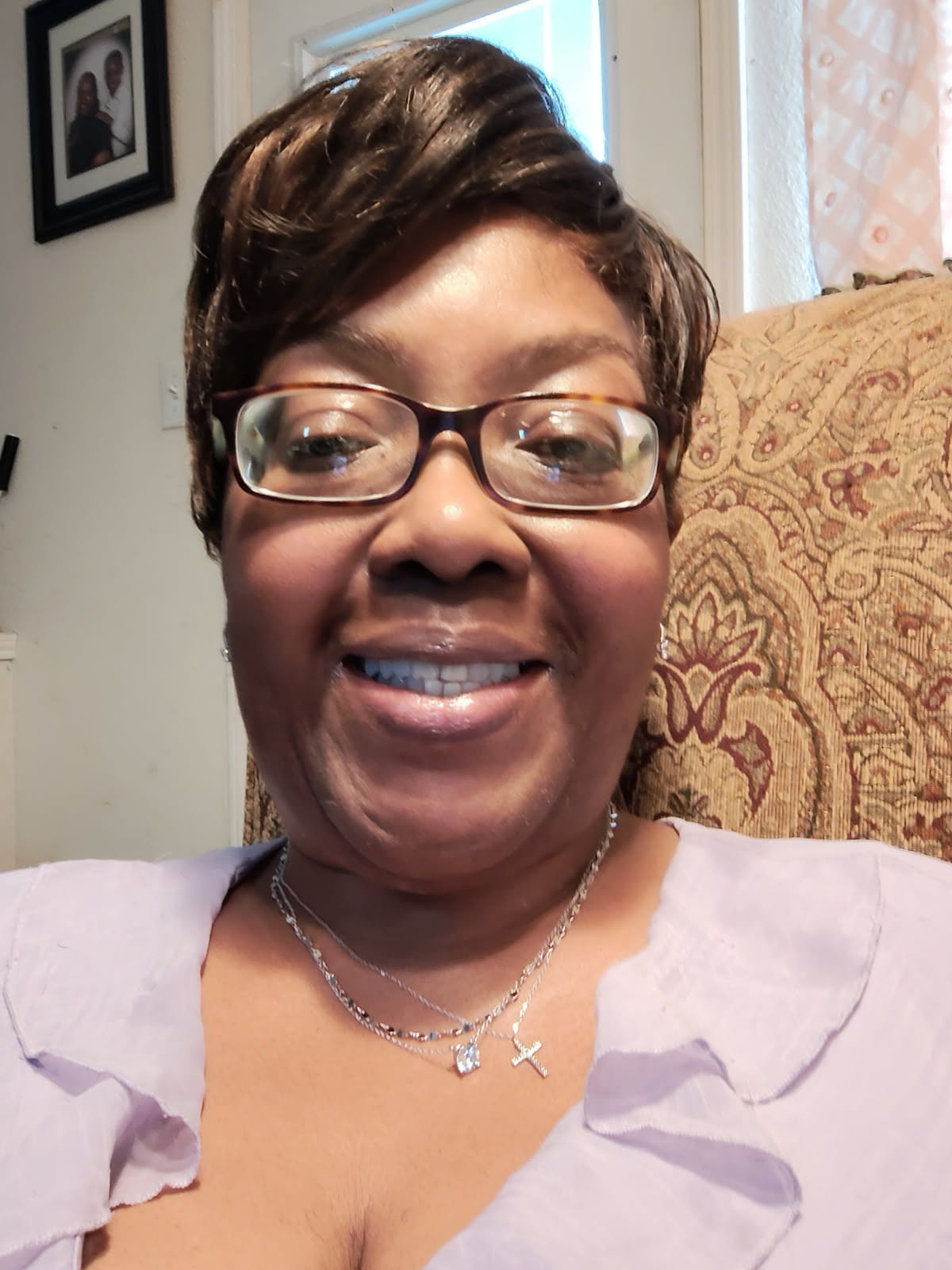

Today we’d like to introduce you to Charlene Dixon.

Hi Charlene , thanks for sharing your story with us. To start, maybe you can tell our readers some of your backstory.

My journey has been shaped by persistence, reinvention, and a deep respect for service. I began my career in public service with the Internal Revenue Service (IRS), where I gained firsthand experience in tax administration, compliance, and auditing. That foundation gave me a unique perspective — I didn’t just learn how returns are prepared, but how they are reviewed, questioned, and sometimes challenged. It also marked the beginning of my career where I understood that, in life, the only constant is “change.”

Over the years, I worked across multiple roles in tax preparation, client service, and financial support, building both technical expertise and an appreciation for how confusing and intimidating the tax system can be for everyday people. Eventually, I created Charlene Dixon Tax Service PLLC – a practice rooted in education, integrity, and advocacy.

Along the way, I’ve navigated significant personal challenges that shaped both my life and my work. The conclusion of a twenty-year IRS career coincided with my unsuccessful attempts to transition into motherhood — a role, two and a half years later, that brought me profound fulfillment as stepmother. It was suddenly becoming a stepmother, to my eight-year-old stepchild that gave me a different and new purpose and perspective, and what I consider my most meaningful role. These experiences, along with many others, deepened my empathy and strengthened my commitment to serving clients with steadfast care and understanding.

Today, my work goes beyond preparing tax returns. It’s about helping people understand their financial picture, avoid costly mistakes, and move forward with confidence. Every chapter of my journey has reinforced my belief that knowledge is empowering — and that trustworthy guidance can truly make a lasting difference.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

It definitely hasn’t been a smooth road. Like many entrepreneurs, my path has included unexpected detours, setbacks, and moments that required me to pause and reassess. My ability to possibly “learn” something new each and everyday has been my saving grace and strength.

Like many entrepreneurs, I’ve had seasons where personal and family health took priority, and I intentionally stepped back from active client work. That time reshaped my perspective. Instead of rushing to rebuild, I used it to reflect, recalibrate, and redefine what sustainable success looks like for me. Rebuilding after a pause requires humility and patience — but it also brings clarity.

I’ve navigated life thus far while staying committed to doing meaningful, ethical work.

There were times when progress felt slow, especially when balancing personal responsibilities with the demands of maintaining a high standard of service for clients. Operating independently also meant wearing many hats — educator, advocate, administrator, and problem-solver — often all at once.

Despite those challenges, each obstacle helped refine my purpose. The struggles taught me patience, adaptability, and the importance of staying grounded in my values. They also strengthened my resolve to create a practice that prioritizes integrity, education, and compassion. Looking back, the challenges weren’t roadblocks — they were lessons that shaped both the business and the person behind it.

Alright, so let’s switch gears a bit and talk business. What should we know?

Charlene Dixon Tax Service, PLLC — known as “theCDTS” — is a boutique tax and financial services practice built on accuracy, education, and advocacy. I work primarily with individuals, families, and small business owners who want more than basic tax preparation and who value understanding the “why” behind their numbers.

Charlene Dixon Tax Service, PLLC was built gradually, often through early-morning meetings at local coffee shops, late-night phone calls, and countless emails from potential clients.

My background with the Internal Revenue Service and decades of hands-on tax experience shape the way I approach my work. I don’t just prepare returns — I help clients avoid common reporting errors, understand compliance requirements, and plan proactively so they’re not surprised later. Many clients come to me after receiving IRS notices or realizing something was missed, and they appreciate having someone who understands both sides of the system.

What sets my practice apart is the emphasis on education and trust. I take the time to explain issues in plain language, empower clients to make informed decisions, and ensure they feel supported rather than overwhelmed. I’m especially known for helping self-employed individuals, healthcare workers, gig workers, retirees, and those navigating life transitions where tax issues can quickly become complicated.

Brand-wise, I’m most proud of the reputation “theCDTS” has built for integrity, patience, and reliability. This is a relationship-driven business, and many of my clients return year after year or refer family, friends, and coworkers because they feel seen, heard, and protected.

I want readers to know that “theCDTS” exists to bring clarity and peace of mind to an often stressful process. My goal is to help people feel confident, informed, and prepared — not just during tax season, but throughout the year. Too many people are being processed instead of guided with tax planning. I wanted to create a practice rooted in education, transparency, and advocacy — not just return preparation, but empowerment.

At the core of my work is a commitment to serve with integrity, compassion, and stewardship — values that guide how I show up for my clients and my community.

What would you say have been one of the most important lessons you’ve learned?

The most important lesson I’ve learned is the value of resilience and self-trust.

Life and business rarely move in straight lines, and I’ve learned that setbacks don’t mean failure—they’re often redirections. Trusting my experience, staying adaptable, and continuing to move forward even when the path is unclear has allowed me to grow both professionally and personally. That resilience now guides how I approach challenges, serve others, and build with purpose rather than fear.

Pricing:

- Services are priced based on complexity and scope. Individual tax preparation, self-employed and small business returns, and advisory services are all quoted individually to ensure clients receive fair, customized pricing. Consultations are available to determine the best approach for each situation.

Contact Info:

- Website: https://www.thecdts.net

- Facebook: https://www.facebook.com/share/16hpbXcJdM/

- Other: info@thecdts.net

Image Credits

Not applicable