Today we’d like to introduce you to Damon Williams.

Hi Damon, please kick things off for us with an introduction to yourself and your story.

I’m a 4th generation son of 5th Ward, born at St. Elizabeth’s Negro Hospital just a few years after its desegregation. It’s an honor to share my story, as a Houstonian, and an aspiring steward of a family legacy that began in the soil of this community. I left Houston for the Navy the day after my 18th birthday. I got to visit some of the world, live in California/Florida/Japan/Cuba, and experience things that seemed only to exist a million miles away from the neighborhood where I began. I returned to Houston in 1996 to figure out how I could have a positive impact on this city of diverse communities.

The next 25 years were spent in furthering my public service. From working for the Texas Legislature, to political campaigns, to Houston City Hall, I took every opportunity to deepen my skills and understanding of how to make a difference in communities that needed to build and maintain critical resources. My consulting firm, TouchPoint Strategies, has created over $500M in public-private partnerships that have resulted in billions of dollars in economic impact. Our team has worked with some of the largest developers and local governments to bring the infrastructure, housing, jobs, and activity that help make neighborhoods into communities.

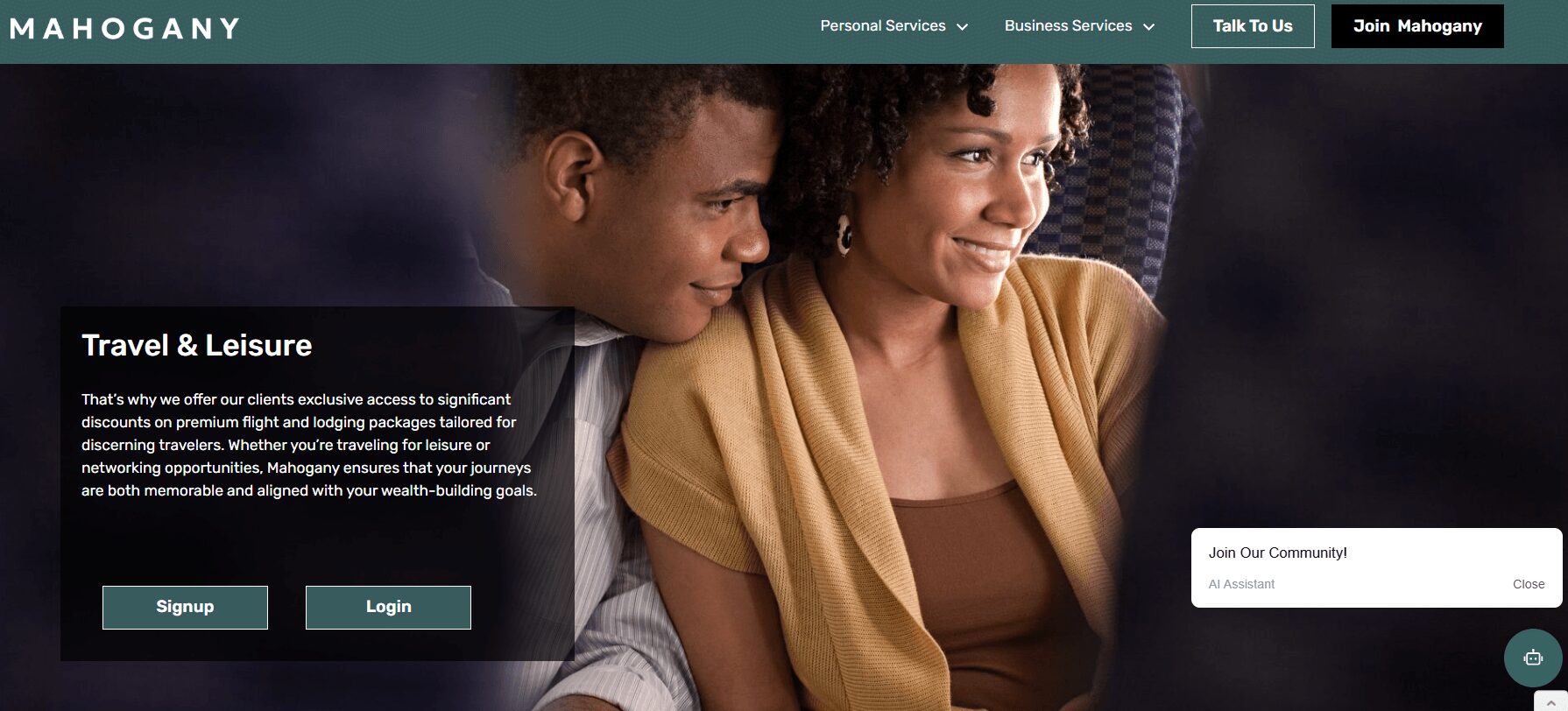

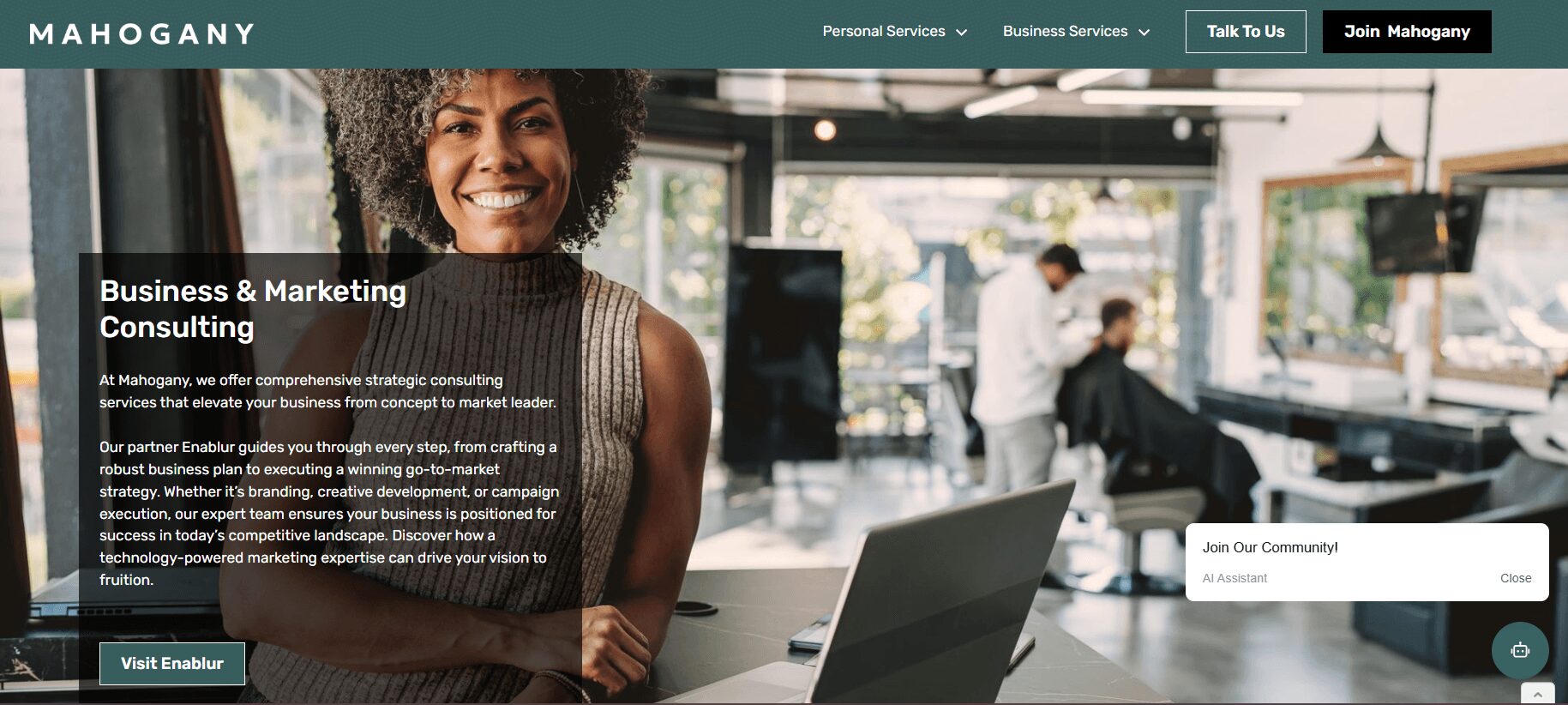

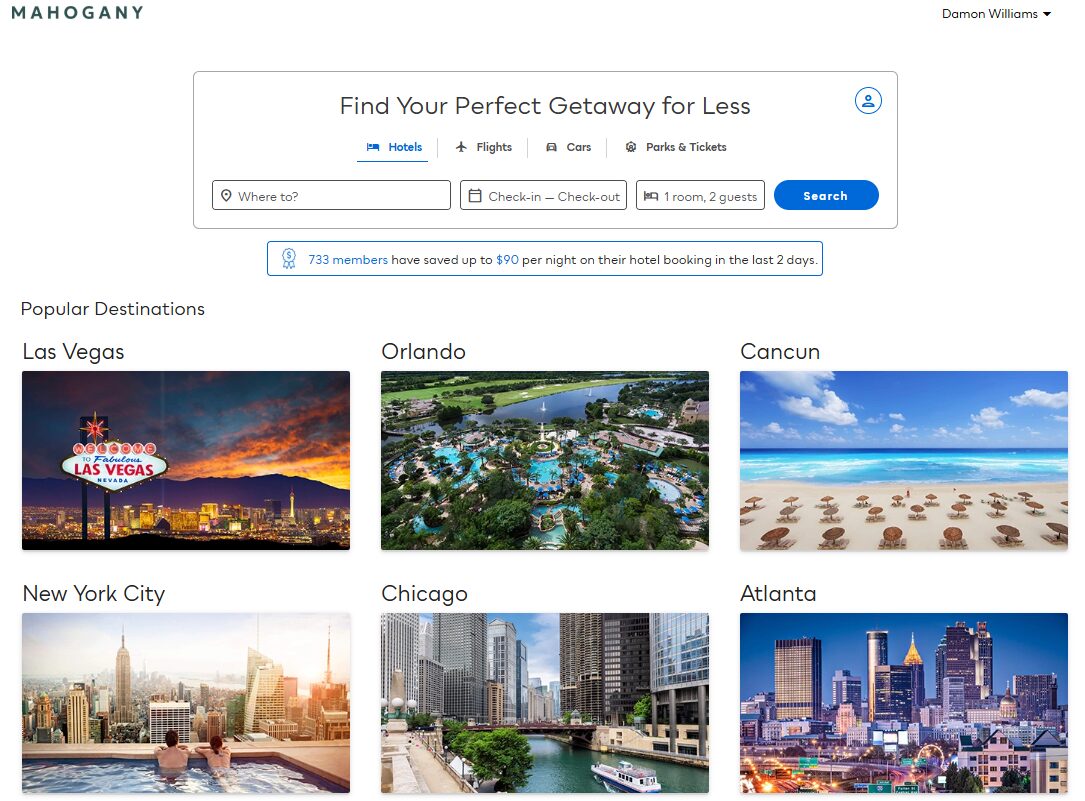

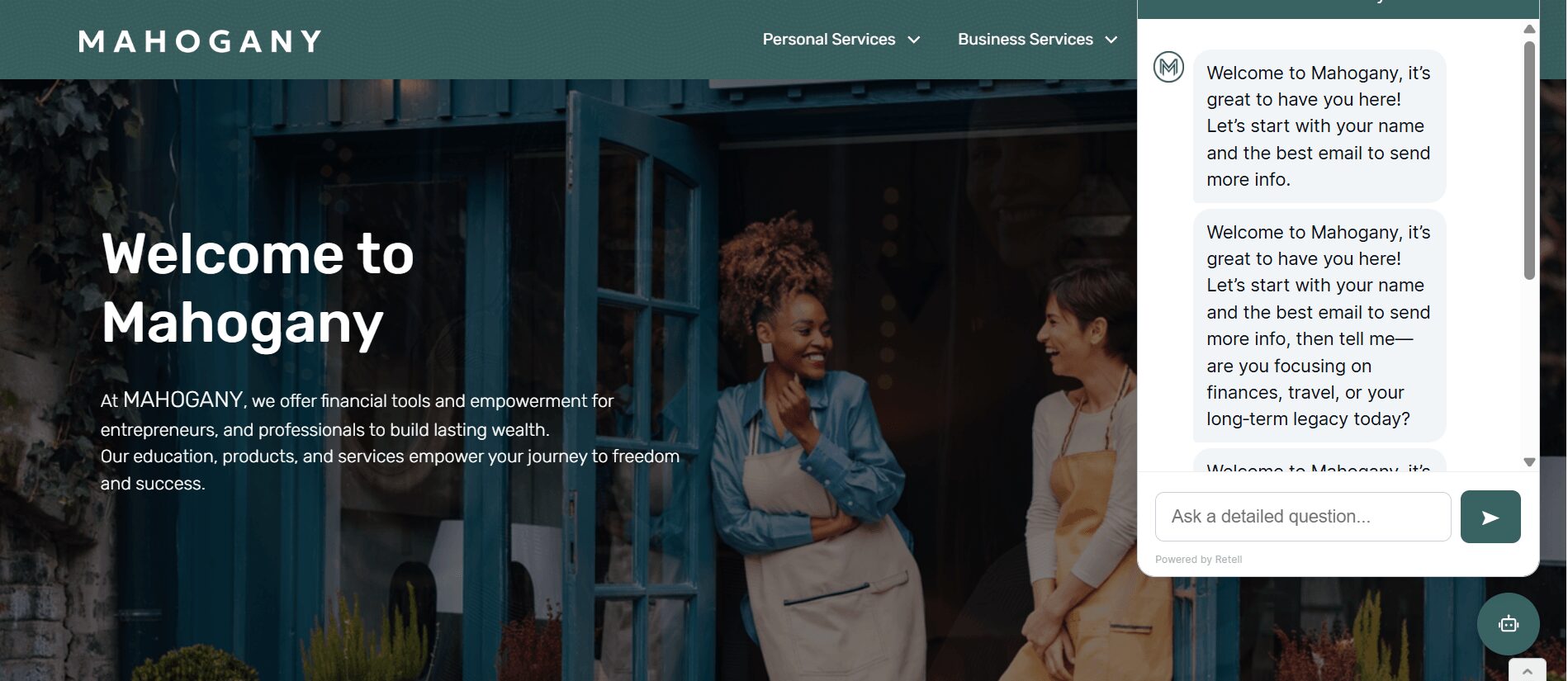

That quest to empower communities has culminated in the 2024 founding of Mahogany Fintech (www.bemahogany.com) where we provide ai-powered financial coaching, capital, and connections for 1st generation wealth builders of our communities to build financial legacies. At Mahogany, we offer financial tools and empowerment for entrepreneurs, and professionals to build lasting wealth. Our education, products, and services empower their journeys to freedom and success.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

No, my road has not been smooth, and that reality shaped the vision for Mahogany. I grew up without a clear blueprint for building wealth. As a first-generation wealth builder, I had to figure out complex financial, business, and life decisions without a safety net. Every step required learning by doing, sometimes failing, and getting back up with more insight and determination.

There were seasons of financial strain while I worked to launch and scale new ventures. I had to self-fund ideas, take bold risks that others doubted, and teach myself disciplines such as finance, technology, and marketing in real time. I encountered skepticism about whether a Black entrepreneur could create a scalable wealth-empowerment platform and had to earn trust from partners and clients one relationship at a time.

Beyond business, there were personal battles as well. I had to overcome doubt, heal from early experiences that shaped my self-belief, and carry the responsibility of breaking generational barriers. Faith, family, and a refusal to quit became my anchors.

Those challenges became the foundation for Mahogany. I know what it feels like to navigate life without guidance, to wonder if wealth and opportunity are reserved for others, and to create a path when no one hands you one. Mahogany was built to make that journey less lonely and more achievable for first-generation wealth builders everywhere. It proves that the path may be difficult, but it can lead to something extraordinary.

As you know, we’re big fans of Mahogany Fintech. For our readers who might not be as familiar what can you tell them about the brand?

Mahogany Fintech is a private, AI-enabled platform built to guide first-generation wealth builders as they define, accumulate, and preserve wealth in every sense of the word. We believe riches are material, but true wealth is how you live, love, and what you leave. Our mission is to meet people exactly where they are on their wealth journey and provide encouragement, education, and strategic tools to help them move forward with confidence.

We specialize in simplifying complex financial and life-planning concepts and turning them into practical, actionable steps. Members gain access to curated training, guided planning resources, personalized AI support, and a community of peers who are also building something bigger than themselves. We are known for blending technology with humanity. Our AI agents offer on-demand guidance and support, but the Mahogany experience feels like a trusted coach who shows up with the right advice at the right time.

What sets us apart is our focus on first-generation wealth builders. Many platforms assume their users have inherited wealth or financial literacy passed down to them. We serve people who are breaking cycles, learning as they go, and creating new legacies. We know their journey is as much about mindset and resilience as it is about money, so we design tools and content that address both.

Brand wise, I am most proud that Mahogany feels warm, aspirational, and credible at the same time. It is modern and tech-forward, yet deeply personal and culturally aware. Our tagline, “Mahogany is ready when you are,” captures our promise to be there when someone decides it is time to step into their power and pursue wealth on their own terms.

For readers, I want them to know that Mahogany is more than a platform. It is a movement that empowers people to navigate money, career, entrepreneurship, and legacy planning with confidence. Whether you want to start investing, launch a business, protect your family, or change the financial future of your household, Mahogany was built to guide and encourage you every step of the way.

Do you have any advice for those just starting out?

My advice to them is to start before feeling fully ready and to commit to learning as you go. Waiting for perfect timing or complete certainty will delay you more than failure ever will. Clarity often comes from action, not from standing still.

I wish I had understood earlier that wealth building is not just about money. It is about mindset, resilience, and relationships. The ability to adapt, to recover from setbacks, and to build a network of people who believe in you matters as much as the dollars you earn. Focus on becoming someone who can solve problems, who can be trusted, and who can keep going when things are hard.

I would also tell my younger self to document every win, your lessons, your goals. When you are breaking new ground as a first-generation wealth builder, there is no playbook handed down to you. You are writing it for yourself and for those who will come after you. Keep your vision close, and revisit it when the road gets tough.

Finally, remember that no one builds anything meaningful alone. Seek mentors, partners, and communities that challenge you and believe in you. Ask questions, share your journey, and stay open to guidance. Your dream may start small, but it can become much bigger than you imagine if you keep showing up.

Contact Info:

- Website: https://www.bemahogany.com

- Instagram: https://www.instagram.com/be.mahogany/

- Facebook: https://www.facebook.com/bemahogany.vip/

- Twitter: https://x.com/Be_Mahogany

- Other: https://www.tiktok.com/@be.mahogany

Image Credits

The images are all owned by Mahogany Fintech.