Today we’d like to introduce you to Dianne Brown.

Hi Dianne, so excited to have you with us today. What can you tell us about your story?

I’ve had many jobs throughout my life, including a role as a college professor, and I’ve always loved sharing knowledge with others. One day, I was invited to a PHP presentation by one of the agents, and the financial information they shared was completely new to me. That’s when I realized there were many others like me who needed guidance on planning for their financial future. The Black community has long been overlooked and underserved when it comes to financial literacy and planning. So, I decided to join the team, and now I’m nearing the end of my third year.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

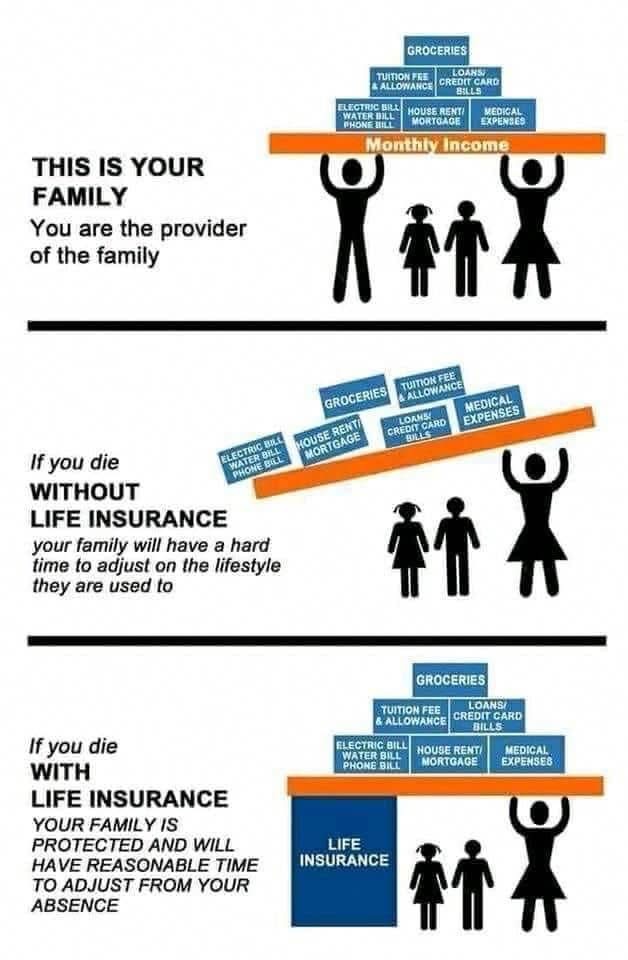

None of my previous jobs have been as challenging as working in life insurance. In the Black community, the topic is often considered taboo due to a lack of education. Many people overestimate the cost of coverage and are reluctant to spend money needed for other expenses. There’s also a level of mistrust toward agents who often don’t “look like them.”

As you know, we’re big fans of Family Finance/PHP. For our readers who might not be as familiar what can you tell them about the brand?

PHP is a brokerage, so agents are considered independent business owners. That gives me the ability to offer others a two-fold opportunity. They can become a client by purchasing life insurance or an annuity, but they can also join my team as a business partner and educate others, helping them to plan for their futures as well.

I’ve attended many events in the community such as job fairs and back to school giveaways to meet the members of the community and let them know what I offer. I stress the importance of knowing how money works and how life insurance can be a wealth building tool for help with college expenses, buying a new home, or protecting you in retirement with supplemental income.

My broker teaches classes twice per week and I encourage those I meet to attend one of our workshops and learn how money works. Even if someone does not take advantage of the products or the opportunity, I am confident that our workshops will give them the knowledge to make an informed decision about protecting their financial future.

I’m proudest of the fact that several of my clients have seen the value of our products and purchased policies for their children, grandchildren, great grandchildren, and even their nieces and nephews.

Is there anyone you’d like to thank or give credit to?

My husband is my ‘silent partner’. He provides manual labor when I do an event and refers clients sometimes. The coaches/brokers in my agency always encourage me to do my best. They will run an appointment, make phone calls, and attend events with me to help me improve.

Contact Info:

- Website: https://www.family-finance.co

- Instagram: https://www.instagram.com/familyfinanceco

- Facebook: https://www.facebook.com/dbfamilyfinance

- LinkedIn: https://www.linkedin.com/in/diannebrown