Today we’d like to introduce you to Jerome Chenevert.

Jerome, we appreciate you taking the time to share your story with us today. Where does your story begin?

My story starts in a little town called Barrett, Texas. Located in East Harris County. I was raised in a very traditional French Creole family that migrated from Southcentral Louisiana. My grandfather was an English Second Language learner, so the order of the day was church, education, and work. I attended catholic school until grade eight, where I got my first taste of leadership. I was elected class president of my 8th-grade class. This propelled me into leadership roles in various organizations. At age 15, I visited 4 countries in Africa (Senegal, Togo, Mali, and Cote d’Ivoire ). This experience gave me insight into the importance of education and economics. I completed high school in the top 5% and as class president. These early experiences gave me a solid foundation.

My college years provided a platform to expand my horizons. I attended Hampton University in Hampton, Virginia. There I began my studies in electrical engineering. However, after the first summer and fall semesters, I realized I did not want to be an engineer. I changed my major to economics. This was a choice I made after visiting every single major at Hampton. I noticed every major had to take math, English/literature, and some form of economics. After I changed my major to economics, I started to pay attention to how money works. I noticed how credit card companies bombarded college campuses, student loans were the primary form of tuition payment, and the cost of everyday goods was increasing. These observations and experiences helped me to realize the important role economics plays in life. While at Hampton, I pledged Kappa Alpha Psi Fraternity, Incorporated. I became Chapter President (Polemarch) and the delegate to the National Konclave (1997). I was also able to explore entrepreneurship. I formed a tutorial service company with one of my fraternity brothers. He was a school teacher in the local school district, which made it easy to get clients. Senior year was met with excitement and a major life-changing event. My first child was on the way.

Upon graduation from Hampton University, I landed a job in retail bank management. I spent two years in this post and changed career paths to financial services. At the time, I was living in Baltimore, Maryland. There, I began to build a firm by hosting financial planning seminars. I gained a lot of traction; however, life had other plans. My personal life got turbulent and forced me to return to Texas. The return to Texas brought its own string of challenges. I ended up teaching to ground myself. Little did I know this would be another major turning point in my life. I put my financial services practice to rest and focused on educating future generations. After two years in education, I started an after-school program that later became a tax-exempt 501 (c)(3). During my third year as a certified public educator, I noticed the need to help other educators build wealth and prepare for retirement. I started offering financial services for educators on a part-time basis. I continued this practice until I left public education. Also, during this timeframe, I completed a Master’s degree in Educational Technology. I spent 16 combined years in public education.

Outside of my progressive career in financial services and education, I was able to meet one of the greatest people on earth, my wife. She has supported me through every imaginable instance. Her loyalty and commitment fueled my progress. She has been a stay-at-home mom. We have six children, 5 of whom we homeschooled. While learning wifehood and motherhood, she was still able to acquire two degrees. She now assists with the current business and continues to be magical and amazing. I also participate in local community development. In this capacity, I have served in the civic league as vice president, president, and board member.

Over the past three decades, I have gained education, skills, and learned experiences that have prepared me to help others with their finances. I have employed my knowledge, skills, and know-how to create Green Life Consulting, LLC.

Green Life Consulting, LLC is my current business enterprise venture. We focus on helping people navigate unique financial situations. Being a husband, father of 6, community leader, and business owner- I understand the value of time and money. Through Green Life Consulting, I combine all of my experiences to deliver a service message that helps, empowers, and inspires others.

We all face challenges, but looking back would you describe it as a relatively smooth road?

There is a wise saying, “the hotter the battle, the sweeter the victory.” No, it has not been a smooth road. Some of the struggles along the way were the normal lack of enough resources to complete a project, partnerships going bad, impulsive decision-making, and poor timing. Going through these situations is where you find your strength. If you are not faced with challenges, you will never grow. I think one of the most important aspects of the journey is emotional regulation. Through emotional regulation, you see challenges as growth opportunities. It has not been smooth and easy, but it has been worth it.

Alright, so let’s switch gears a bit and talk business. What should we know?

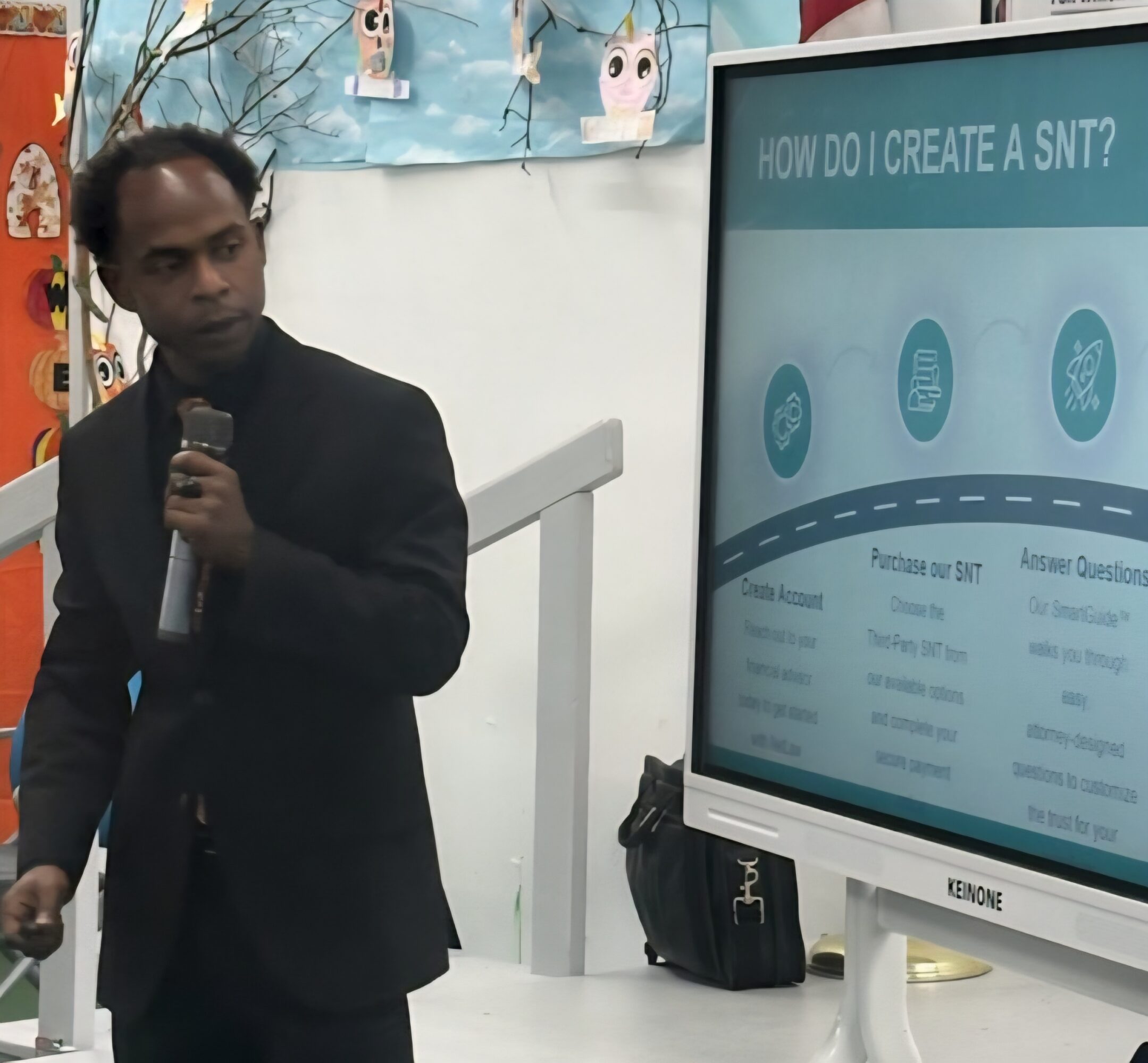

Green Life Consulting, LLC, empowers individuals, families, and business owners to achieve their financial goals, secure their futures, and navigate the complex landscape of personal finance and wealth building with confidence and peace of mind. We emphasize the integration and coordination of financial decisions with clients’ goals, values, and priorities. We use a unique and specialized process to design financial models, enabling clients to increase their wealth building and protection. We specialize in comprehensive insurance (auto, home, life, commercial), retirement income planning, and estate planning. We use these three financial pillars to educate clients on how money works. When a person understands how money works, he or she is better equipped to make informed decisions.

What differentiates Green Life Consulting is our ability to truly connect with our clients and provide the exceptional and compassionate service they deserve. Through our client engagement process, we collect data to verify and assess clients’ present position. Next in our process, we identify goals, challenges, and resources. Once we have a complete financial profile, appropriate financial strategies are determined to develop and implement a Wealth Strategy. After the strategy is implemented, we cultivate the relationship through ongoing engagement and periodic reviews.

Currently, we offer a complimentary Wealth Strategy Session. This session is designed as a discovery meeting for introductions and goal setting. We also host seminars to provide financial literacy and education. We are not one of the big brand names in financial services; however, we can compete and in some cases do better. This is attributed to our expanded lived experiences and care for others. Financial wellness is a self-discovery journey.

What do you like best about our city? What do you like least?

What I like best about the Houston area, it’s a great place to start a business, raise a family, and live a good life. Houston is an extremely diverse city. Your exposure to themes and people who can expand your ideas and thinking is limitless. As someone who appreciates variety, it keeps life interesting.

What I like least about our city is the traffic and driving habits of some folks.

Pricing:

- Complementary Wealth Strategy Session

Contact Info:

- Website: https://www.greenlife-consulting.com

- Facebook: greenlifeconsultingllc