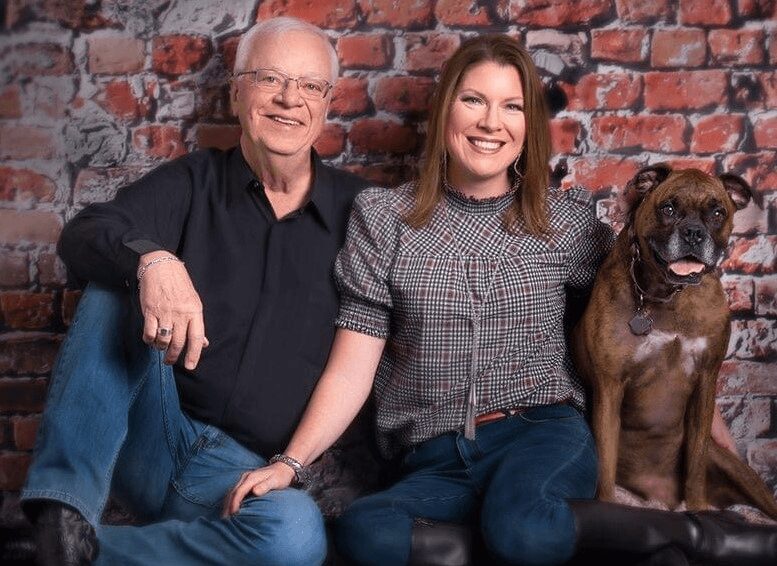

Today we’d like to introduce you to Natalie Saikowski Goertz

Today we’d like to introduce you to Natalie Saikowski Goertz

Hi Natalie, so excited to have you with us today. What can you tell us about your story?

Growing up in The Woodlands and raised by two parents who went to Texas Tech University, being a Red Raider was all I dreamed of when it came to college. I attended Texas Tech University for three years where I was in the Kappa Delta Sorority, but was constantly home sick. As someone who navigates life with ADHD, my business classes were hundreds of students in a large auditorium. The professors read us their PowerPoint presentation, then gave us a scantron test. This type of learning was not beneficial to me, so I made the tough decision to leave Lubbock and enrolled my Senior year in Huntsville at Sam Houston State University. I received a wonderful education with 20-30 students per class and the test of knowledge was more application through hands on projects. Upon graduating from college at Sam Houston State University December 2000 with a Bachelors in Business Administration, I worked for Anadarko Petroleum in the Land Administration Department for three years. After surviving numerous rounds of layoffs, I vested early by working overtime on specialty projects and later completed real estate school. I became a licensed Real Estate Agent for residential buyers and sellers at Keller William Realty and thrived in the industry. My type A driven personality positioned me for success where I worked seven days a week on an adrenaline rush of a career for more than three years.

While working as a licensed Real estate Agent, I discovered that banking should be on my radar. My real estate background provided me with the knowledge to earn my first banking job June 2006 at Woodforest National Bank where I began my career as a Private Banking Loan Assistant to two Executives. My banking career is a great example of someone starting at rock bottom and continuing to rise to each given occasion by which I constantly excelled. After fulfilling this position for a year, the female Executive I worked for wrote me a letter of recommendation for a different position, which is how I joined the Treasury Management team in a niche banking market called Treasury Management. I started as an Assistant before being promoted to an Analysist and then a Sales Associate. I was quickly promoted to a Junior Treasury Management Officer. In 2011, I was promoted to Treasury Management Officer and later promoted to Assistant Vice President in 2013.

After a successful career in banking, I joined my husband September 2014 at our company, Mr. Rooter®, to work on some special projects that required a business owner’s mentality. While at Mr. Rooter®, I wore many hats, including, but not limited to, marketing and community development, vendor management, contract management and negotiations, accounts receivable and collections, plus managed the Logistics Team. I was responsible for establishing our Logistics Team’s Reference Guide, which helped ensure all team members are utilizing the same guidelines to achieve their job responsibilities and provide outstanding customer service. Through my diligence, background and negotiation skills, I saved Mr. Rooter® more than $100,000 per year in payables. Upon taking the position as Executive Vice President, I quickly branded myself as the “Mrs. to the Mr. at Mr. Rooter® Plumbing” and took the plumbing industry by storm. Not only was I the featured talent in our commercials for the local TV stations, but I helped the company earn numerous prestigious awards, which included, but are not limited to, Woodlands Online’s “Business of the Year” in 2019, Woodlands Online’s “Best of The Woodlands 1st place each year 2015 – 2019, Living Magazine’s “Reader’s Choice Awards” Winner 2015 – 2018, Conroe/Lake Conroe Chamber of Commerce “Small Business of the Year” 2017 as well as Lone Star College Small Business Development Council “Small Business of the Year” Top 3 2014 – 2016. I was also named “Faces of The Woodlands” in 2017. You will note that our business started receiving these consecutive annual awards upon me joining the company and working hard to make our brand known throughout the community.

With the knowledge that we were going to sell our Mr. Rooter® company, I began interviewing with banks to join their Treasury Management Team. Prior to joining Guaranty Bank & Trust March 2019, I had more than a handful of banks reach out to me with job offers because they knew my reputation, skillset and wanted me to join their team. At Guaranty Bank & Trust, I served as Senior Vice President in a dual capacity role of Treasury Management Officer and Community Development Officer. I managed the bank’s corporate and public fund portfolio throughout the entire state of Texas.

After resigning from the bank March 2023, I was going to be a banker on a sabbatical and travel with my husband, Roger, for the remainder of the year. It was the first time in my adult life I could travel and not field phone calls, texts and emails from work. We took many unforgettable vacations and created lasting memories. Upon returning home from lunch with a girlfriend October 2023, I bounded through the side door of our home and told my husband I wanted to start my own business to advocate for business owners in our community. I was going to marry my banking and business owner backgrounds. My ADHD brain was on overdrive and I immediately began writing my website content. Within 24 hours, it was completed. I named my company Business and Banking Concierge, LLC, purchased my website domain, selected my colors, created my logo, ordered business cards and stationery, then contacted my attorney. I quickly learned I should have contacted my attorney first because there was a problem filing my entity documents with the State of Texas. The word “Banking” was in my company name, but I was not an actual bank collecting money. My attorney wrote a letter to the Texas Department of Banking asking for their approval of the entity name for which approval was less than 50%. My heart sank and I quickly had to demonstrate patience, which is not one of my strengths. The State of Texas did grant approval of my entity name, Business and Banking Concierge, LLC, which is a testament of the validity for my company to exist.

I am fortunate to have achieved various accomplishments throughout my career regardless of the industry. My determination, grit and passion have allowed me to earn notable professional awards and achievements, which are as follows:

• Named “Chapter Chair of the Year” by Greater Houston Women’s Chamber of Commerce – February 2020 and 2023

• Leadership Montgomery County Inaugural Masters Class – Graduated May 2023

• ATHENA International Leadership Award Winner – July 2002

• Founded Women Bankers in Montgomery County, TX – June 2022

• Named “Volunteer of the Year” by Greater Houston Women’s Chamber of Commerce – February 2020 and 2021

• Named “Woman of Distinction” by the Women’s Council of Organizations – May 2021

• Greater Houston Women’s Chamber of Commerce Thought Leaders Institute – Graduated May 2021

• Appointed to Serve on Three Bank Committees – 2020, 2021 and 2022

• Rotary Club Paul Harris Fellow Award recipient – June 2020

• Named “Trail Blazer” by Greater Houston Women’s Chamber of Commerce – November 2019

• Named “Champion of Literacy” by Children’s Books on Wheels – August 2019

• Woodlands Online “Business of The Year” – 2019

• Woodlands Online “Best Of The Woodlands” 1st Place – 2015, 2016, 2017, 2018, 2019

• Living Magazine’s “Reader’s Choice” Winner – 2015, 2016, 2017, 2018

• Conroe/Lake Conroe Chamber of Commerce “Small Business of The Year” – 2017

• Lone Star College Small Business Development Council “Small Business of The Year” – Top 3 (2014, 2015, 2016)

• Leadership Montgomery County Graduate – Class of 2014; Chaired one of three project site locations; Current and active Alumni

My personal awards and achievements are as follows:

• Named “Mistress of Ceremonies” by National Charity League, Inc. The Bluebonnet Chapter – February 2022

• Sponsored by Texas Beef Council for marathons and triathlons – January 2014-Present

• Named “Couple of The Month” for the April 2019 edition of “Life on the Green” Magazine

• IronMan Texas Half IronMan Finisher – October 2018

• Montgomery County Sheriff’s Office Citizen’s Police Academy Graduate – Class of 2017.2; Current and active Alumni

• Named “Faces of The Woodlands” – July 2017

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

My career path has not been a smooth road and I have had to overcome struggles along the way regardless of the industry. It builds character for those who address such struggles. Most of my career has been in male dominated industries. As a strong willed female, I had to work twice as hard, which paid off and allowed me to create a brand for myself that stands for excellence, precision and resiliency. I learned how to earn the respect of my male colleagues and began to have a seat at the table. My business and life Mantra is “Get up, dress up, show up and never give up!”

I always enjoy a good challenge! One of my biggest accomplishments was having some of the bank’s most difficult customers eating out of the palm of my hand. There was a specific customer who had tens of millions of dollars in the bank and the male executive leadership team was trying to schedule an important meeting with the principal owner to discuss fraud prevention services and other Treasury Management services. Their requests went unanswered. The business owner would not speak to any of the executives who reached out. I chimed in as the female Treasury Management Officer and said I could help secure the meeting because I knew this gentleman through our years of community service together. They all looked at me like “Yeah, right! We’ve tried without success. Let’s see what you can do.” Within a week, I had a meeting scheduled and he brought his team to sit around the Board room table to engage with the banking team. I took control of the meeting, educated the client and he agreed to implement all Treasury Management services I proposed. He knew these services were to his benefit since he knew I had his best interest in mind from a need perspective and not greed.

As the President, Founder and CEO of Business and Banking Concierge, LLC, my biggest struggle has been educating business owners about what my company offers. No one else has the same business model as I have created, so it has been a continuous educational opportunity to share my story. Within the first six months of launching my company, I received recognition from business and community leaders acknowledging my company’s existence. I now receive referrals from accountants, attorneys, bankers, CPAs and wealth management advisors, as well as friends, family and neighbors, who know my brand stands for excellence.

Appreciate you sharing that. What should we know about Business and Banking Concierge, LLC?

Business and Banking Concierge, LLC is an independent advocate for new and existing businesses of all sizes to help establish strategic banking and other vendor relationships. Our goal is to maximize cash flow, reduce expenses and enhance productivity while managing risk exposure.

I founded Business and Banking Concierge, LLC on four key principles.

1. Educate Business Owners to become empowered to make banking, insurance and other business related decisions

2. Challenge myself to identify cost savings opportunities and enhance efficiencies

3. Continuously advocate for business owners

4. Share my love for all things business and banking

Business and Banking Concierge offers an innovative, yet unique boutique style company. The white glove concierge level of my services is what sets me apart from others. I have a career long history of providing the white glove level of service to my clients regardless of the industry I served in, so this is a natural fit. I am most proud of my Business and Banking Concierge brand because I am the brainchild behind it and no one else has the same business model.

In our personal lives, we often outsource some of our responsibilities due to either time constraints, lack of desire or skillset, which is why I started my own company so I could be an independent advocate for business owners. It was during my banking career when I realized companies of various sizes were being under served while being over charged. As an awarded former small business owner and seasoned banker, I bring a unique skillset to the industry. Both of my granddaddy’s were small business owners, my daddy is a small business owner and I married a small business owner. Small businesses are the heart beat of America and now I have the privilege of being a female owned small business owner.

High Level Strategy Solutions Offered

• Bank Relationship Review of 5 Key Functions – Bank Account Structure, Cash Flow Cycle, Internal Controls, Fraud Prevention Services and Manage Risk Exposure

• Bank Selection Process – Research and intimately interview banks of interest while comparing accounts and services offered as well as pricing

• Business Strategy Solutions – Examples may include learning how to get involved in the community and meeting your target market, writing employee job descriptions, writing internal policies and procedures, creating and/or updating employee handbook, learning how to consistently host a team or companywide meeting, learning how to build a successful team and more

• Insurance Administration – Organize all commercial policies, analyze existing policies and provide cost savings proposal, perform annual risk assessment and facilitate annual renewals

• Loan Requests – Identify lender or lenders to entertain category of loan request

• Fraud Disputes to Recuperate Lost Funds – Assist with the process to have disputed funds returned to you

• Merchant Processing – Analyze merchant statements and provide cost savings proposal through a network of independent merchant processing companies

• Lockbox Solutions – Expedite collection of receivables and maximize funds availability

In terms of your work and the industry, what are some of the changes you are expecting to see over the next five to ten years?

Over the next 5-10 years, I see an ever evolving landscape in the banking industry on a variety of levels. As customer service becomes a lost skill set, service industries, such as the financial industry, are going to have to reteach and deepen this soft skill. Competition will become more equalized from a technological perspective and it’s the white glove level of service that will set one apart from their competition. I also believe we will see more mergers and acquisitions of banks and credit unions. Based on my banking experience, bankers have historically paid more attention to the customers in their loan portfolio and not necessarily customers who have no loans. As lending has declined due to the current rate environment, banks are aggressively going after deposits. To be successful, bankers are going to have to shift their mindset and begin paying attention to their assigned customers who do not have loans in order to retain their deposits and potentially attract additional deposits. It is a lot more effective to retain existing clients than lose them and try to attract new clients.

Contact Info:

- Website: https://businessandbankingconcierge.com/

- Facebook: https://www.facebook.com/profile.php?id=61554088363087