Today we’d like to introduce you to Tracie Lampson.

Hi Tracie, thanks for sharing your story with us. To start, maybe you can tell our readers some of your backstory.

We retired in 2011. All the company-sponsored events were held by financial institutions that the company used. Our belief, like 99% of others, was our company would not put us with someone that didn’t have our best financial interest at heart. We unwittingly went with the company to manage our assets. We retired at 57 1/2, so we had to borrow our own money until we turned 59 1/2. We were told this was the best financial approach, and it would allow our entire portfolio to continue to grow and keep pace. Our particular broker seemed to want to know all about us. He got interested in our son’s high school and college baseball career, so to us, it was more than a business relationship.

After year 2, our portfolio was only growing at less than a 4% rate, while the market had just gone thru 20%-40% increases. Our broker told us that we told him at our initial meetings that we needed XXX $$$ to keep our lifestyle and that would mean making from 3%-8%. So, since we made almost 4%, he felt he did his job. We were not happy with this answer and decided to sell our company stock and take a huge market gain with the intention of just holding it for future investments. We did not want to create any taxable event. When we did this, we also told our broker we were not happy with the 4%, based on market gains of double digits. We decided to move our account. The broker did not even make an attempt to keep our business even though we had well over $2M.

From that point forward, the broker never contacted us to try to keep our business, period. Five days later, his assistant called and said our loan was being called on margin. We were shocked. We had some $960K in cash in this account as a result of the stock sale. We were told that cash was not collateral and that we had to pay the loan off in the next 10 days. Needless to say, this cost us a 6-figure tax event. We took this to arbitration as we contended this was not in the brokerage agreement, that cash was not collateral, plus we contented that our broker should have had the fiduciary responsibility to tell us when we placed the sale order of the stock that this would cause a margin call. We would not have done it that way so as to avoid the tax event. That was a huge setback in our retirement goals; however… it didn’t phase them one bit. This broker did not even show up at the arbitration. They ended up giving us $5000. The arbitrator was a former broker or judge, I forget now, but it oddly seemed biased. We didn’t have the money to take this big brokerage firm to court, so we had to eat crow.

From this point forward I vowed to learn the retirement business, options, pitfalls, myths, and anything else I could learn to educate people approaching or in retirement on this difficult subject and to help them avoid what we went thru. I had already obtained my insurance license in 2005 by accident. I kept plugging to learn as much as I could and the more, I got into this the more misinformation I saw that was out there and that people were being coerced into bad decisions by people only wanting a recurring annual commission. I saw this as so unjust. These people make money annually on your money regardless if they make you money or lose you money. And they can give you no guarantee if they will make you money and don’t fully explain that if the market is up, you still aren’t making money unless you sell and get out with the profit.

So, I began looking for other product(s) that allowed you market-style gains while minimizing market-style risk. That is something a broker cannot and will not say or put in writing. I wanted a product that would allow you a % of the market gains but without the worry of any losses if the market dropped. Low and behold, I stumbled across insurance-based products that do this and substantially more. Not only do these products give you market-like returns, but many exceed and give you participation that exceed that actual performance than the index they are attached to. Coupled with that, some even have a zero floor that my initial investment so that any gains credited to my account can never be lost through the contractual period. So therein lied the risk/reward of the products we offer. Brokerage accounts have fees that can never be avoided. Regardless of age, brokers, who are good at accumulation, almost never recommend moving out of market-based products. There comes a point in everyone’s life when they no longer need to accumulate; they need to preserve and have a strategy to withdraw with adverse tax penalties. We have those solutions.

We all face challenges, but looking back, would you describe it as a relatively smooth road?

It is an ongoing struggle to overcome the misinformation about insurance-based annuities, cash-value life insurance, or pension-style annuities. So many people have a hard time “breaking up” with their current asset manager. They have built a relationship that they feel is hard to walk away from. So often, clients come to us who have not opened a statement in years because they are either too concerned about possible loss, too trusting of their advisor, or quite simply, they do not understand what they are looking at. Even in the face of seeing their accounts actually going backwards, big time in some cases, they seem to freeze and don’t do anything. Their brokers feed them the line that the market always has ups and downs, and it will come back. But again, it is paper money, and what if it doesn’t come back or you lose 40% overnight like in 2008.

That is where Lampson Retirement Solutions has positioned itself in 2023. We have new offices in Kingwood, Texas. We have an eight-person team, and my Partner and I are in all the initial meetings. You get to meet us and know us because you have to feel comfortable and at ease with the person that you are going to help you invest your money to give you a worry-free retirement. Unlike brokers, if we can find a way to never charge a fee, we will do it. Whether it is answering calls 24 hours a day, performing annual reviews so that our clients understand exactly what’s in their statements, or processing withdrawal requests, we will find a way to make sure there are no fees assessed to our clients when possible. We have clients whose contracts we have serviced for over a decade, who have never had one dollar in fees to us or inside of their contract. Our motto is to “Enjoy the Ride and Not Having to Watch the Gas Gauge.” We love our work.

Thanks – so, what else should our readers know about Lampson Retirement Solutions?

We are a small, 8-person organization that tailors to YOUR individual needs. We do not cookie-cutter your plan. We painstakingly look at your income streams, expenses, lifestyle, legacy needs, etc., and feed all of that into our financial analysis and generate the best plan to meet your needs and goals.

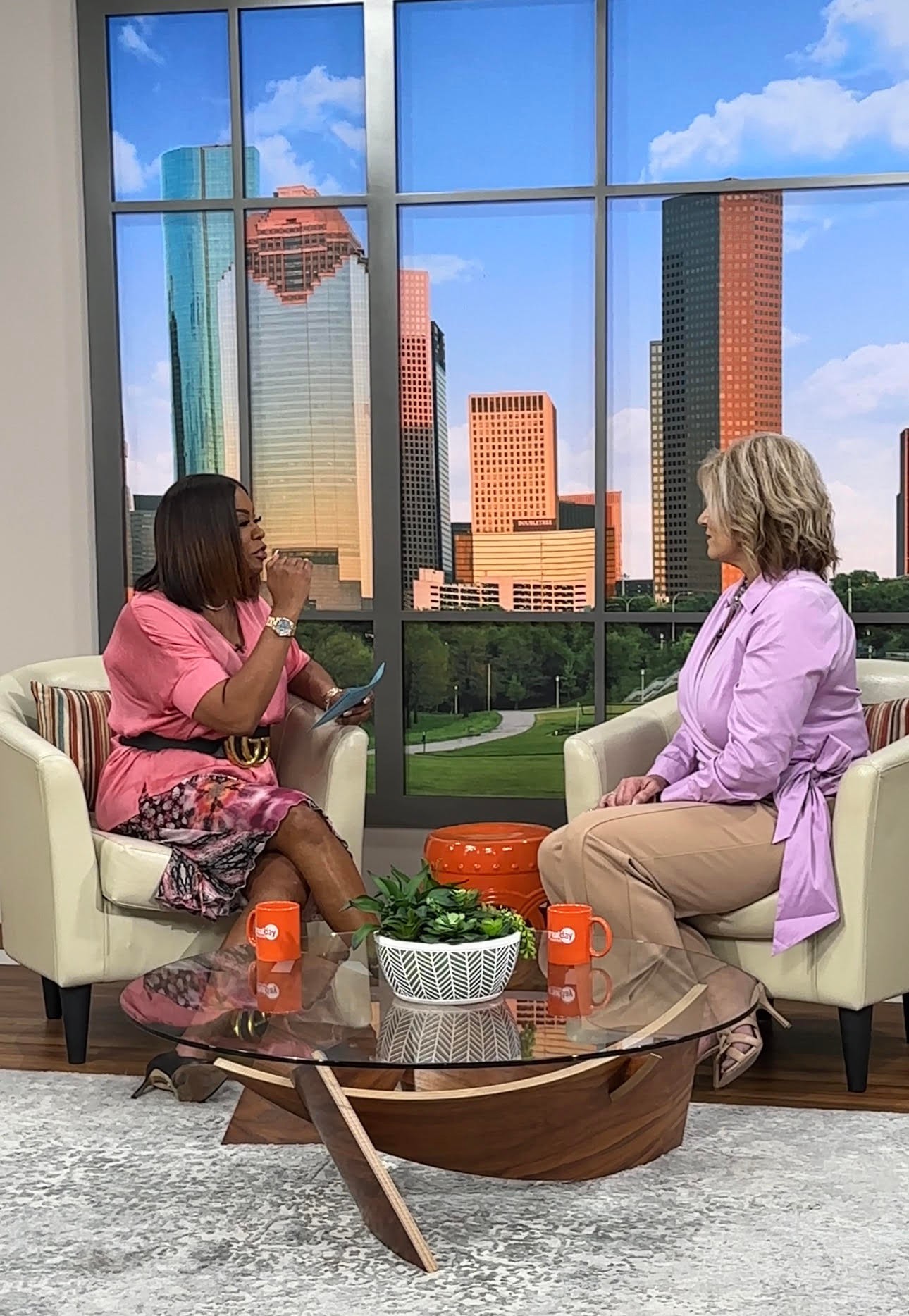

We are known for our personalized service, and the I, as the owner, is in the office every day and meet all prospective clients. They know me and get to see my passion as I exhibit on the monthly television program – Great Day Houston with Deborah Duncan. Our client are from every walk of life, and we treat each customer with dignity and respect. We also are honest and upfront in that if we can’t help you, we will tell you quickly so we don’t waste each other’s times.

As for our brand, we deal with only A or better-rated carriers. We also want our clients to know that our fees are paid to us by the insurance company we place the contracts with. The fee or commission we get DOES NOT come out of your initial investment. If you start with $100K, we get our commission once the account is funded. That is it. We get paid that one time,

We want people to know as much as they can so as to make the best decision. When they come in for their annual review, we want no surprises. We want their statement to be simple to they can see exactly what they stated with, what they have made, and how all this aligns with their long-term goals. Preservation is the name of the game as this point in most of our clients’ lives. Most of our clients generally have at least $500k in assets they want to protect, and we do the best job around to show them how we can meet all their goals.

Is there a quality that you most attribute to your success?

Personality On Site

Availability to meet Prospect/Client Needs

In Office meetings

Zoom Meetings

“We come to you meetings” if you have special needs

Warm, clean, inviting offices

Friendly staff

Experienced financial staff that personally handles your financial analysis

Honesty

Trustworthy

Willing to educate with sympathy (we have been there)

Pricing:

- The financial analysis is generally a $1,000 value that we do for free.

Contact Info:

- Website: www.lampsoninc.com

- Instagram: https://www.instagram.com/lampsonretirement/