Today we’d like to introduce you to Tylisha Summers.

Today we’d like to introduce you to Tylisha Summers.

Hi Tylisha, so excited to have you on the platform. So before we get into questions about your work-life, maybe you can bring our readers up to speed on your story and how you got to where you are today?

My husband, Kiley and I found ourselves in more than $140,000 of consumer debt. After getting our finances in order and sharing our story with close family and friends, we realized there were many other people, who, like us, were caught in the never-ending debt spiral without a means to improve their finances. God planted the vision in Kiley to create a tool to help people get out of debt. One thing we knew was that people were and would continue spending money, even while in debt. However, Kiley wanted to help people help themselves by creating a tool that would allow them to pay down their debt as they spend money. And this is how Spendebt was born.

After creating a simulation to see if the tool would work as we thought it should, we found developers to create the app as well as to get the website created. If we would have known what we know now, we would have learned how to code while in college. Coding is an invaluable skill that will save you time and a lot of money if you know how to do it yourself!

We are a bootstrapped company that has funded our startup through our own personal investment, along with a host of earnings from pitch competitions and business accelerators. One of the first companies we talked to (i.e. cold call to this company) was MasterCard when we only had an idea of what we wanted Spendebt to be. We could have never envisioned that years later, we would be selected as the first early-stage startup selected to participate in MasterCard’s Start Path program. And receive funding from MasterCard to support our expansion to the B2B2C space!

The entrepreneurship journey is not a straight path and is not always filled with glitter and gold. Along our journey, we have been faced with challenges. However, we always fall back on remembering our why. Spendebt is allowing us to help people break generational curses. And if we stop, we could make an entire generation miss their blessings! So we show up each and every day to fulfill this part of our God-given purpose in life.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

I am not sure there is any life experience that offers a smooth road. Nevertheless, the entrepreneurship journey is always moving, shifting and throwing in plenty of challenges along the way to see how tough your skin is. Specifically for us, one of our initial challenges was finding a dev team that could support our needs and growth. Fortunately, after about 3 teams, we have hit the jackpot and have been with our current dev team for a few years now!

An on-going challenge has been funding. We are a bootstrapped company and have funded our business through an initial personal investment, earnings from pitch competitions and accelerators. However, based on limited funding, we are proud that we were able to build a financial technology company and we have been able to help people pay off student loans, auto loans and credit cards to name a few! One of our recent success stories involves helping someone eliminate two credit cards and a by-now-pay-later loan, improving their credit score by 110+ points and helping them improve their finances to purchase a new home!

None of our challenges outweigh the gratitude and fulfillment we receive from helping people! Personally, by becoming debt free, we were able to improve not only our finances but our mental and physical well-being. Additionally, we were able to look beyond the debt and start our own company! Finances are the second most cause for stress in Americans. Spendebt provides an easy way, working in parallel with their everyday spending to help them overcome the debt burden.

As you know, we’re big fans of Spendebt. For our readers who might not be as familiar, what can you tell them about the brand?

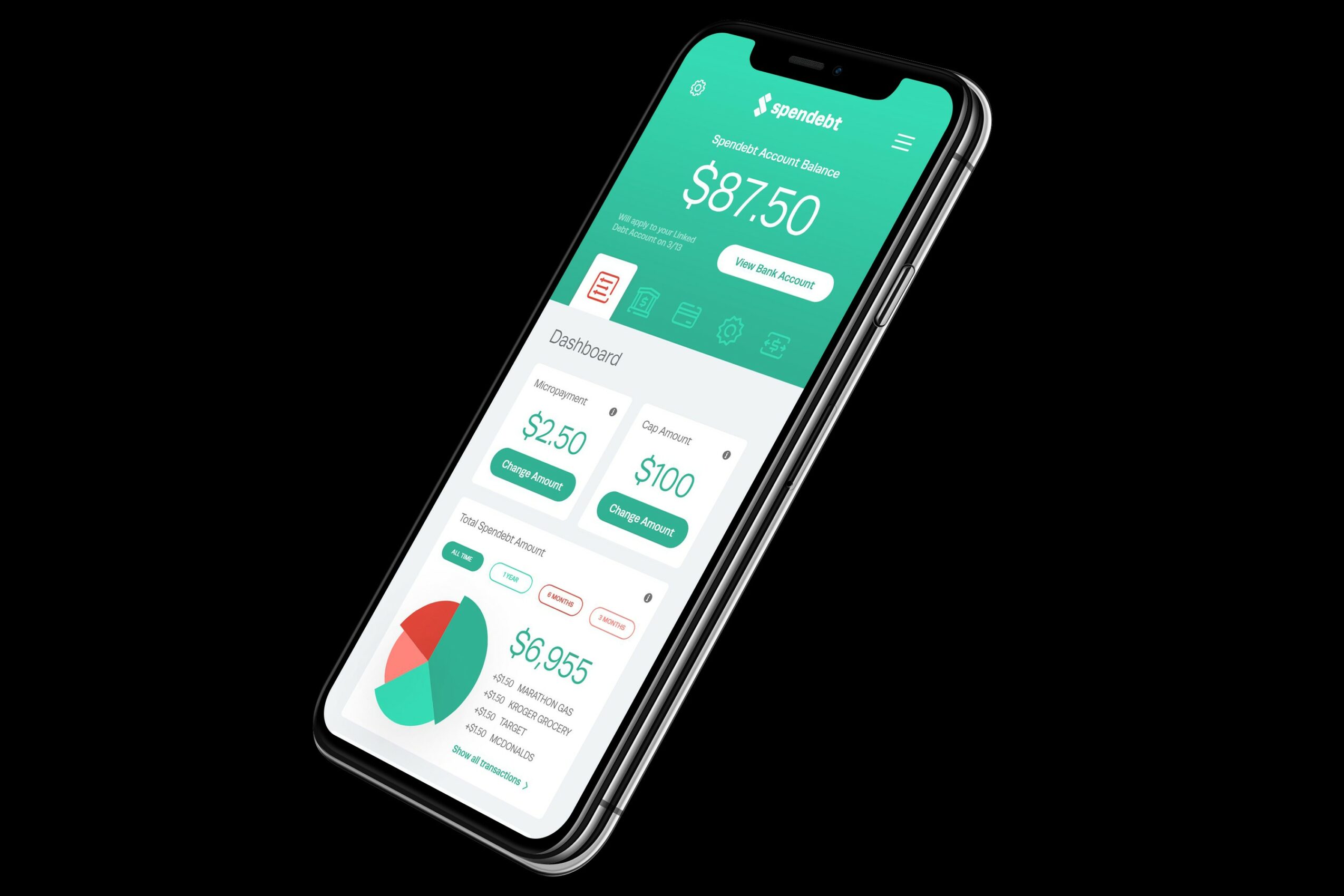

Spendebt allows people to select their own micropayment (or small amount) that is automatically removed from their connected bank account every time they swipe their debit card or have a banking transaction. Users can adjust their micropayment at any time. Spendebt can help users pay down any type of debt balance that is owed. From student loans to mortgages to Peloton bike balances.

My husband/co-founder and I know that Spendebt works because we used the same approach with our personal finances to become debt free. The method has been validated personally by us and now by our customers!

Try it out for free for one month to see how it works! You won’t be disappointed!!

Are there any books, apps, podcasts or blogs that help you do your best?

Netflix – Get Smart with Money (financial series)

Books: Second Chance: for your money and your life

Influencers – Budgetnista, Ross Mac, Chris Choi

Pricing:

- First month is free

- $3.99 per month thereafter

Contact Info:

- Instagram: www.instagram.com/its_spendebt

- Facebook: www.facebook.com/spendebt

- Twitter: www.twitter.com/spendebt

![]()