Today we’d like to introduce you to Kyle Trotman.

Alright, so thank you so much for sharing your story and insight with our readers. To kick things off, can you tell us a bit about how you got started?

I embarked on my journey to build a real estate portfolio two years ago. Armed with determination, a passion for real estate, and no investors, I knew I had to get creative with financing options and leverage sweat equity to make my dream a reality.

My journey began with extensive research. I spent countless hours studying the local real estate market, investment property types, and financing options. I decided to start small with a duplex, as it offered the perfect balance of potential rental income and manageable maintenance costs. After a couple months of searching, I found a promising property with loads of potential. I knew through hard work and commitment, I could bring out the hidden potential.

To finance this purchase, I used a combination of my personal savings and an FHA loan. This mix allowed me to make a competitive offer on the property and secure it. I purchased the property in February of 2021, when interest rates were at record lows. This was a huge plus as it reduces the mortgage payment, which increases the rental profit.

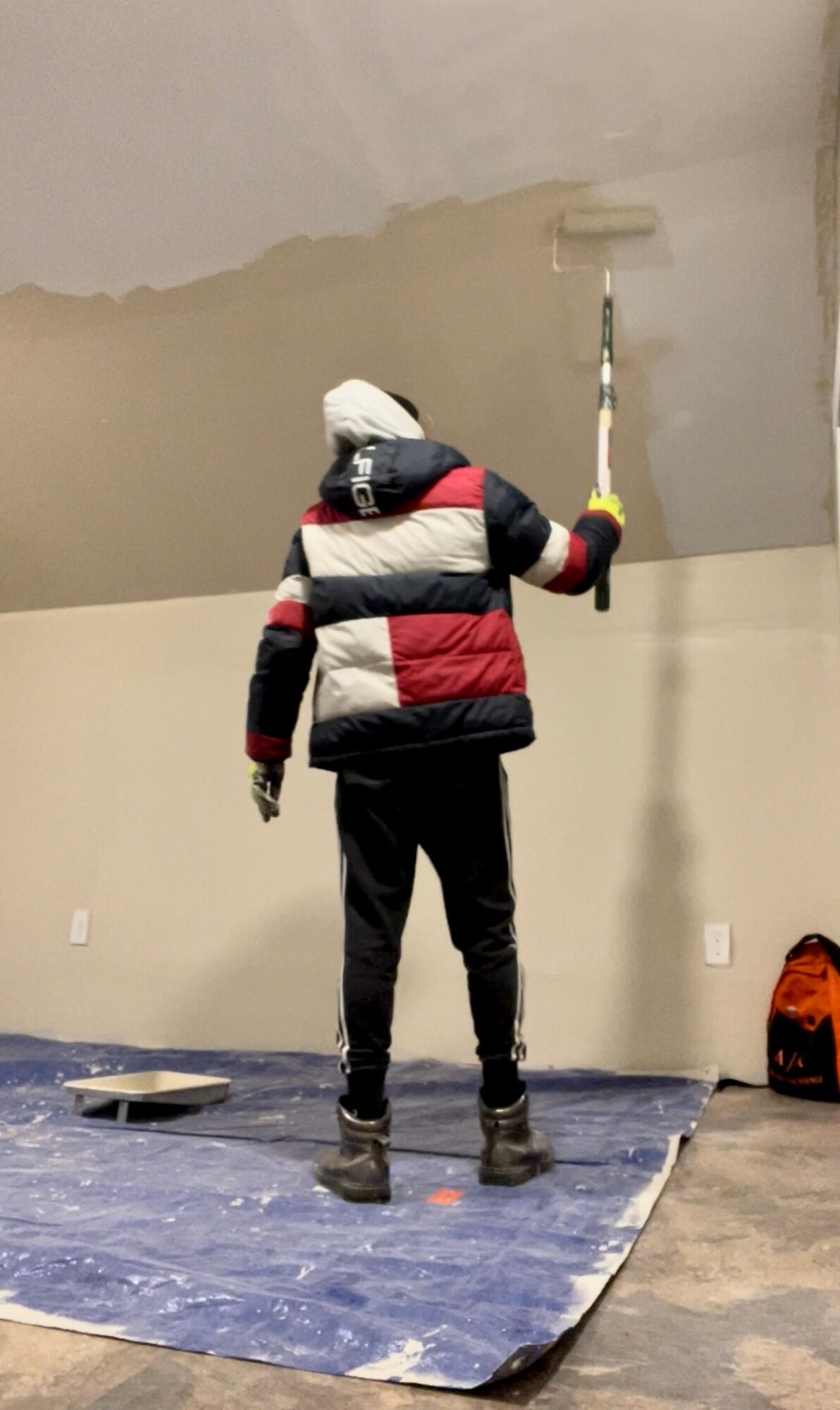

The real work began as soon as I took ownership of the property. With the help of family, acquaintances, and small local contractors, we rolled up our sleeves and began renovating the duplex. It was hard work and had its challenging moments, but the sweat equity put into the property saved a substantial amount of money. Making sweat equity worth double.

Once the renovations were complete, I listed both units for rent. The open houses were saturated with potential tenants. This was a great thing and also meant a new form of sweat equity would now be required. I made the transition from hands-on work in the field to filtering through over a hundred rental applications. I was able to narrow it down to two amazing families that have been great tenants from the start.

With the first property successfully generating cash flow, I moved on to the next one. I wanted to purchase a property that wouldn’t require a loan or mortgage. That meant I’d need to look for off-market deals, and the property would likely need tons of work before it’d be move-in ready. I eventually found a single-family home that required a full rehab. I followed the blueprint from my first property and completed the rehab in 9 months. I rented this property for 7 months before putting it on the market and selling it for more than twice the original purchase amount. I used the funds from that sale to purchase a turnkey-ready single-family home and partner on a 4plex property, which required another full rehab. Each property brought its own set of challenges and opportunities, but I continue to leverage hard work and sweat equity through my journey.

Over the last two and a half years, my real estate portfolio grew from that initial duplex to include a single-family property and several multi-family properties. The rental income provided financial stability, and the appreciation of the properties continuously adds to my net worth. I plan to reinvest my profits into new acquisitions, always looking for properties with potential for value-add improvements.

As my portfolio expanded, I began to hire workers to handle the day-to-day operations, allowing me to focus on further growth and investment opportunities.

Through persistence, creativity, and a lot of hard work, I continuously add to my goal. It’s the furthest thing from easy, but the journey is incredibly rewarding. So far, my experience has taught me the importance of financial savvy, sweat equity, and the power of networking in the world of real estate investing.

We all face challenges, but looking back, would you describe it as a relatively smooth road?

Real estate investing can be a rewarding endeavor, but it’s not without its fair share of challenges, particularly when dealing with contractors and projects. One of the most significant challenges is finding reliable and trustworthy contractors. Many investors struggle to identify contractors who deliver quality work on time and within budget. It often requires a lot of trial and error to find the right fit. Unforeseen issues can also eat into your potential profits. Time is money in real estate investing, and project delays can be costly. Delays can occur due to various reasons, including weather, permitting issues, labor shortages, or contractor scheduling conflicts. These delays can disrupt your cash flow and overall investment timeline.

As you know, we’re big fans of you and your work. For our readers who might not be as familiar, what can you tell them about what you do?

I’m a real estate owner and investor known for my impressive achievements in the world of property investment. Over the past two years, I’ve started an impressive portfolio of investment properties. As a dedicated landlord, my commitment to providing quality living spaces is evident. I take pride in maintaining high standards and ensuring tenant satisfaction, establishing a reputation for reliability and professionalism.

What matters most to you? Why?

What matters to me most is family. My children are my world. The motivation for this journey began with an obsession of building generational wealth. In the world of real estate, tenant safety, and comfort is at the top of my list. I embrace the responsibility of providing nice, affordable housing to families in the community.

Contact Info:

- Instagram: https://www.instagram.com/verifiedsupreme/

- Facebook: https://www.facebook.com/kyle.trotman.16?mibextid=LQQJ4d

- Linkedin: https://www.linkedin.com/in/kyle-trotman-a86901212?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=ios_app

- Twitter: https://x.com/sir_lordoflands?s=21